Neutral Citation Number: [2021] EWFC B102

Case Number: XX20D52905

IN THE FAMILY COURT

Date: 8 December 2021

Before:

DEPUTY DISTRICT JUDGE M DAVIES

-------------------------------------

A

Applicant

- and -

R

Respondent

--------------------------------------

Judgment

1. This is an application for a financial order dated 14 December 2020 made by A (who I shall refer to as the Wife) subsequent to her divorce. Her petition was issued on 1 October 2020 and Decree Nisi was pronounced upon 17 December 2020. The decree is yet to be made absolute. R is the respondent to the petition and the Financial Remedy application, I shall refer to him as the Husband.

Background

2. This was a long marriage of some 21 years including premarital cohabitation. The parties began cohabiting in 1999, were married on 23 June 2001 and separated on 20 October 2020. They are 52 and 66 respectively with the Husband being the Wife’s senior by 14 years. They had three children. EE is 19 years old having been born on 3 July 2002 the year after marriage. E is in his second year at University. F was born on 9 March 2004 and would have been 17 years old. She died in the most tragic of circumstances just short of her 16th birthday. G is just 12 having been born on 4 November 2009. He is at School in Town Y and has recently moved into the senior school in year 7. The Husband has two children from an earlier marriage. P and Q who are both independent adults. When the parties separated, they shared the family home for a period but thereafter the Husband lived there with the Wife moving out to live in rented accommodation.

3. The Husband has recently retired from his employment at Town Z University. His USS pension is in payment following his retirement in February 2021. He received a lump sum of £224,902 upon which he has undertaken not to draw. The income he receives from his USS pension is £52,154 gross per annum. He receives his state pension of £9,371 and also undertakes journal editing which provides him with a modest income of around £7,963 on top of his pension payments. This total income would amount to £69,488 gross per annum. Both parties ask me to make a pension sharing order and so necessarily his income from the USS pension will reduce in accordance with the size of the pension debit. I am told it will reduce by £587 per annum for every 1% of reduction at section 1(c)(g) of the addendum report on page E30. The Wife will gain £690 per annum for every 1% of any pension sharing order. I take it that the inverse applies such that the Husband will gain £587 per annum for every 1% reduction and the Wife will lose £690 per annum for every such reduction.

4. The Wife previously also worked at the University in the same department and it may be that their shared workplace provided an introduction for them. She has a PhD and was employed as a full-time lecturer until September 2011. She worked part time for 2 days a week until the summer of 2018. She found lecturing stressful and in 2018 she resigned from the university and began writing and illustrating children’s books. An opportunity arose for her to create sets of books. She completed that work and has begun to produce her own work.

5. All the parties’ children were educated at the same School in Town Y and I am informed that the school fees are £15,000 per annum. G continues there and while the parties appear to agree that he continue there in the future his attendance at that school was not an issue of much mention at the final hearing and the Wife and perhaps the Husband, although he may feel more strongly about it according to the written evidence, suggests that G should remain there as long as it continues to be beneficial and viable.

6. A central feature of this case which is profound in its gravity and tragedy is the fact that F the parties’ middle child and daughter took her own life, at home, shortly before her 16th birthday. One can only begin to imagine the incredible pain and grief that this incident caused, and continues to cause, for the parties and their two sons. I am told, understand and accept that this incident precipitated the breakdown of the parties’ marriage.

7. Within a month of F’s tragic death the country was put under lockdown restrictions as a result of the Covid-19 virus becoming pandemic and reaching the United Kingdom. The parties lived together in the family home until September of 2020. Until then they had remained living under the same roof. In or around September it was initially agreed that a ‘nesting' arrangement be put in place with the parties taking it in turns to live at the property with G, and E when home from university. However, when it came time for the Husband to move out of the property he declined to do so. The Husband was questioned about this action at the final hearing on behalf of the Wife. In any event the Wife moved out taking G and has been renting a property in Town Y ever since. The Husband remains in the family home.

The assets

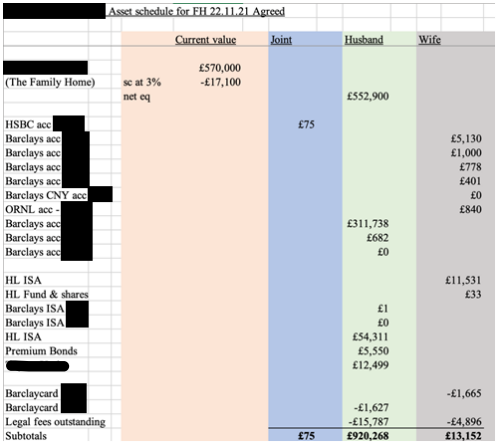

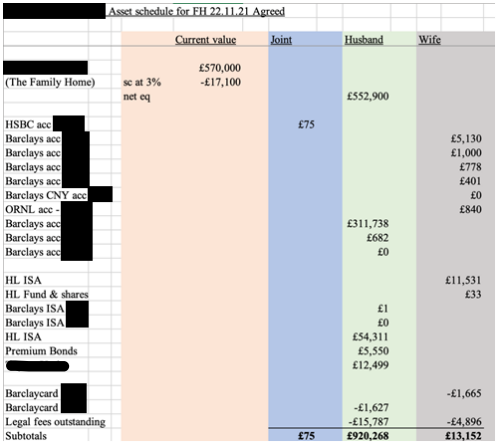

8. I have been provided with an asset schedule which is agreed. I am grateful to counsel for the schedule and particularly that it is agreed. I therefore adopt the schedule in its entirety, save for that information below line 35 which is not agreed and was inserted by Mr. F on behalf of the Husband for illustration purposes. That which is agreed is set out below.

9. The family home is in Town Z. It has a value of £570,000 and equity of £552,900 after 3% costs of sale. Both parties have pensions with USS from their employment at Town Y University. The Husband’s fund has a CEV of £1,181,755 which would have been over the lifetime allowance by £108,655 and so presumably incurred a tax charge when he took it in February 2021. The Wife’s fund has a CEV of £242,673. The Husband drew his pension on or around 16th February 2021. A letter of that date confirmed that he would receive a tax-free cash lump sum of £224,902.99 and a pension of £4,335.28 per calendar month which is equivalent to a gross income of £52,023.36. The lump sum was received, he undertook to retain it in full and has done so. The Wife, at 52, can take her pension at 55 but with actuarial reduction. She told me in evidence that she will take her tax free cash lump sum at that date. Her normal retirement age, in respect of her USS pension scheme is 65 as it was for the Husband. The pension credit she will receive from any pension sharing order is not available to her until she is 60 according to information received from the Single Joint Expert Mr. Crowley the Pensions on Divorce Expert (“PODE”).

10. The Husband has savings of £311,738 made up predominantly from the tax free cash lump sum he received. He also has an ISA and some premium bonds and the family car (with its agreed value of £12,499). After the deduction of his Barclaycard and outstanding legal fees he has total capital of £920,268 with the family home or £367,368 without it.

11. The Wife has some savings and an ISA and after deduction of her credit card and legal fees outstanding has £13,152. There is a stark difference between their personal wealth.

12. The total asset pot without pensions and with liabilities and outstanding legal costs deducted comes to £933,495.

The Law

13. The Matrimonial Causes Act 1973 sets out the statutory framework. The powers available at this final stage of the proceedings are provided at sections 23 to 24A. The criteria I apply are set out in section 25. Those criteria bear recital:

25 Matters to which court is to have regard in deciding how to exercise its powers under ss 23, 24, 24A, 24B and 24E

(1) It shall be the duty of the court in deciding whether to exercise its powers under section 23, 24, 24A, 24B and 24E above and, if so, in what manner, to have regard to all the circumstances of the case, first consideration being given to the welfare while a minor of any child of the family who has not attained the age of eighteen.

(2) As regards the exercise of the powers of the court under section 23(1)(a), (b) or (c), 24, 24A, 24B and 24E above in relation to a party to the marriage, the court shall in particular have regard to the following matters –

(a) the income, earning capacity, property and other financial resources which each of the parties to the marriage has or is likely to have in the foreseeable future, including in the case of earning capacity any increase in that capacity which it would in the opinion of the court be reasonable to expect a party to the marriage to take steps to acquire;

(b) the financial needs, obligations and responsibilities which each of the parties to the marriage has or is likely to have in the foreseeable future;

(c) the standard of living enjoyed by the family before the breakdown of the marriage;

(d) the age of each party to the marriage and the duration of the marriage;

(e) any physical or mental disability of either of the parties to the marriage;

(f) the contributions which each of the parties has made or is likely in the foreseeable future to make to the welfare of the family, including any contribution by looking after the home or caring for the family;

(g) the conduct of each of the parties, if that conduct is such that it would in the opinion of the court be inequitable to disregard it;

(h) in the case of proceedings for divorce or nullity of marriage, the value to each of the parties to the marriage of any benefit which, by reason of the dissolution or annulment of the marriage, that party will lose the chance of acquiring.

14. Subsections (1) and (2) (a), (b), (c), (d) and (h) are most relevant and I bear them particularly in mind. Section 25A provides a duty to achieve a clean break. The parties agree a clean break should be achieved. It provides (at subsections 1 and 2):

25A Exercise of court’s powers in favour of party to marriage on decree of divorce or nullity of marriage

(1) Where on or after the grant of a decree of divorce or nullity of marriage the court decides to exercise its powers under section 23(1)(a), (b) or (c), 24, 24A, 24B or 24E above in favour of a party to the marriage, it shall be the duty of the court to consider whether it would be appropriate so to exercise those powers that the financial obligations of each party towards the other will be terminated as soon after the grant of the decree as the court considers just and reasonable.

(2) Where the court decides in such a case to make a periodical payments or secured periodical payments order in favour of a party to the marriage, the court shall in particular consider whether it would be appropriate to require those payments to be made or secured only for such term as would in the opinion of the court be sufficient to enable the party in whose favour the order is made to adjust without undue hardship to the termination of his or her financial dependence on the other party.

15. The three principles derived from Miller v Miller; McFarlane v McFarlane [2006] UKHL 24 of Sharing, Need and Compensation must be considered and applied. Compensation does not arise in this case. It’s settled law that the applicant is entitle to the greater of that which she would receive under the application of the needs or sharing principle. Here the needs of the parties are for housing and income in retirement. In the case of the Wife she also has an immediate need for income. The parties have agreed that can be met by two years of periodical payments of £20,000 per annum but capitalised in a £40,000 lump sum.

16. The exercise of the court established by statute and refined by case law was summarised by Lord Wilson in Scatliffe v Scatliffe [2016] UKPC 36 at para 25 (x):

In an ordinary case the proper approach is to apply the sharing principle to the matrimonial property and then to ask whether, in the light of all the matters specified in section 26(1) [of the local Act, corresponding to section 25(2), MCA 1973] and of its concluding words, the result of so doing represents an appropriate overall disposal. In particular it should ask whether the principles of need and/or of compensation, best explained in the speech of Lady Hale in the Miller case at paras 137 to 144, require additional adjustment in the form of transfer to one party of further property, even of non-matrimonial property, held by the other.

17. The enquiry is in two stages. The first is computation and the second distribution. In this case computation is straightforward, it is distribution that has prevented a compromise and which the court must decide.

18. The law in respect of pension sharing orders since their introduction at s24B of the Matrimonial Causes Act 1973 by the Welfare Reform and Pensions Act 1999 has not been developed in reported cases. Since the 2019 report of the Pensions Advisory Group there has been greater focus and discussion upon pensions in the Financial Remedy Court. One case of particular assistance since the publication of the report is W v H [2020] EWFC B10 a decision of His Honour Judge Hess in the Family Court sitting at Swindon.

19. In that case HHJ Hess held:

62. In dealing with the question when should the court disaggregate the pensions in the case and promote a discrete and equal division of the pensions as opposed to attempting to execute an offset against other assets I have the following observations:-

(i) The orthodox view, encouraged by Thorpe LJ in Martin-Dye v Martin-Dye [2006] 2 FLR 901, is that pensions should be dealt with separately and discretely from other capital assets and with a view to their post-retirement income producing qualities. The PAG report offers a similar view: “try, if possible, to deal with each asset class in isolation and avoid offsetting…a discrete solution which equalises pensions by pension sharing orders and which equalises non-pension assets by lump sum or property adjustment orders” (page 35).

(ii) It is undoubtedly the case, however, that many litigants choose to blur the difference between the categories and engage, to a greater or lesser extent, in an offsetting exercise. It needs to be borne in mind, however, that mixing categories of assets runs the risk of unfairness in that valuation issues become very difficult and, absent agreement, it may be unfair anyway to burden one party with non-realisable assets while the other party has access to realisable assets.

Pensions

20. The key issue in this case is not the question of whether or not the assets should be divided equally. It is how that equality should be achieved in light of all the circumstances of the case which include the section 25 factors.

21. The Husband contends that the Husband and Wife should each receive the same sum in cash, by a sale of the family home and division of all capital, as well as a pension sharing order to provide them with equal income in retirement. The percentage to achieve an equal income retirement has been provided by the PODE in an addendum report dated 6 July 2021. He concludes that by a 36.91% pension sharing order against the Husband’s USS pension scheme each party would receive an income of £32,904. This figure was calculated upon the assumption that the Husband would receive his income now, reduced to this proportion, and the Wife would receive hers from the age of 65 which would be her usual retirement age as a member of the USS scheme.

22. The Wife wishes to partially compromise her right to a pension sharing order providing equal income in retirement in order to balance her retention of the family home. Her retention of the family home would lead to an imbalance in capital and she therefore seeks a partial offset of her pension share to account for that.

23. Necessarily, therefore, the PODE has been asked to assist with offset figures. In his initial report dated February 2021 he gave figures for pension sharing at section 4 and figures for offsetting at section 5. Initially he provided only offsetting figures to offset the entire pension which neither party sought and was unlikely to be required. I have not seen the letter of instruction and so can say no more about the instruction.

24. After the first report dated 2 February 2021 an email was sent to The PODE on 28 April 2021 by those instructed by the Wife asking:

a. To update calculations as the Husband had then retired:

b. To clarify why the lump sum the Husband received was higher than anticipated; and

c. To advise what percentage Pension Sharing Order should be reduced by every £10,000 of cash offset in favour of either party.

25. This last question sought a calculation and figures to allow the Wife to make her argument that she should keep the family home, and the extra equity in it, in lieu of a portion of the pension share that she would receive if equalising income in retirement.

26. The PODE in his report takes an unusual approach to offsetting pension sharing orders. In section 5 of his report he gives a one page explanation, on page 10 of the report at E010. He explains that the CEV is usually significantly lower than the ‘full value’ and gives the reason, this is familiar ground for practitioners in this field. He then provides a full value for the parties’ funds. These were updated in the second report and so those figures should be used. He takes the mean of the full value and the CEV in each case and applies deductions to that by means of percentages. He deducts 40% for a full tax and utility adjustment and 0% for no adjustment for either. He also provides figures for a tax only deduction which he puts at 16.033%.

27. This approach to offsetting is not something that is referred to in the PAG report at 7.24 to 7.30. At 7.24 the report provides possible valuation methodology to be adopted by experts. 7.24 (a) suggests a defined contribution fund equivalent. That is what the PODE has done but he has tied that value to the CEV which we know to be inaccurate without good explanation in his report. Paragraph 7.24 (b) of the PAG report does not apply as these are defined benefits schemes, 7.24 (c) involves analysis of the parties’ capacity for risk which we do not have, (d) refers to a full value but with adjustments that appear unlike that of the PODE in this case and (e) is based upon Duxbury which assumes a high level of risk for the claimant. 7.25 suggests that (a), (b) and (d) are likely to be appropriate in most cases

28. So, not only is the PODE’s approach an approach one does not routinely come across in practice but also it is not one referred to at all by the Pensions Advisory Group or explained by him in his report. He does provide figures for offsetting based upon the PAG report if the court chose not to follow his “averaging method”. However, while he did provide a percentage deduction to make from the percentage required to achieve income in retirement in line with the PAG report to account for taxation he did not in his report assist in calculating a reduction for utility other than using his averaging method. While it appears to be common ground, as provided at 7.38 of the PAG report that the PODE should not comment on utility there was left a lacuna in the evidence by not providing me with an accurate reduction of the share to provide for utility. Mr. S for the Wife made submissions that he sought on her behalf a tax only offset and so didn’t ask the expert to assist with utility calculations. Mr. F for the Husband stated that as they opposed an offset he also did not request the information. In a case in which offsetting, that is whether to offset and if so how, is the key issue then in my judgment parties and their representatives must ensure that the information is provided to the court in order that a determination of the appropriate utility adjustment upon the facts of that particular case may be made.

29. It was for this reason that I asked the advocates after their submissions to make an enquiry as to whether there was a calculation that could be undertaken using the figures provided to provide a range of percentages that would allow me to deduct for both utility and taxation using the PAG method. I also asked at what age the Wife could take her own USS pension and at what age she could take the pension credit she would receive as a result of a pension sharing order.

30. I am grateful to those instructed by the Wife and to the PODE for responding to my request. In total I received four emails after closing submissions and before judgment from the PODE. They were emails of 25 November, 26 November, 3 December and 6 December 2021.

31. The first email attached a document entitled USS ER ERET tables Final Salary version 1. That document provides for early retirement under the USS scheme and gives percentages for early retirement at ages 55 to 65. As an example, if the Wife were to retire at the age of 55, as she stated in evidence, she would receive 66.3% of her pension being the actuarial reduction because the income would be paid for 10 years longer.

32. The email also answered my question as to whether the percentage reduction that the PODE had provided to adjust for tax at 16.033% could be used to calculate reductions for both tax and utility. The answer given by the PODE appeared to miss my point and instead deal with how the adjustment for tax would not be a straight line or linear. Alternatively, I don’t understand his reply. The following day he responded further in writing providing a table with, in my judgment, insufficient explanation. My question was about adjusting for utility and his reply did not refer to utility directly.

33. Further questions were sent to the PODE on 29 November 2021 and on 3 December 2021 he resent his email of 26 November without further explanation. Then on 6 December a further reply was received from the PODE. In that email he explained that he would have to first know what figure the court intended to apply for utility in order to produce a table with utility. While I can understand that this might make the calculations more straightforward I had hoped to receive greater assistance from the expert in order that I could consider what the net effect of differing levels of utility adjustment might have on the parties income in retirement and so a scale of between 0% and 40% (and indeed beyond 40%) would have been of great assistance.

34. Whereas the expert suggests “The PAG report directs experts not to quote figures for utility - we currently still quote a figure in our reports due to frequent requests (at a total of 40% for both tax and utility) as an alternative.” that is not quite correct. The report reads “Unlike tax adjustments, adjustment for utility is not a matter on which the PODE should be expected to comment: any utility adjustment is a matter for s25 discretion exercised to arrive at a fair and pragmatic overall settlement, not a matter of evaluation.” In my judgment, as I have said, in cases in which a partial offset is potentially sought by either party, the Pensions on Divorce Expert should routinely provide a sliding scale of percentages to achieve adjustment of 0% through to 40% (and perhaps beyond) in order that the court, once it has undertaken the adjustment exercise may adjust the pension sharing percentage accordingly.

35. In any event it appears that the expert has now provided a sliding scale as regards the PAG report at 40% adjustment and 0% adjustment (in his emails after submissions) and he had previously provided in his addendum report the figures for 40% and 0% adjustment using his ‘averaging’ method of finding the mean of the CEV and the ‘full value’.

36. Mr. F asked whether I would take further submissions after the receipt of this information. I acceded and asked for submissions in bullet points by 9am on the day before the listed hearing for handing down the judgment. I received such from Mr. S which I have considered.

The factual matrix and my findings

37. The key factual issue in the case was whether the family home should be retained for the benefit of G who is 12. Being the only minor child his welfare is my first consideration. Mr. F, for the Husband, rightly reminds me that G’s welfare is not my paramount consideration as it would be if I was exercising powers provided in the Children Act 1989. It is my first consideration. Mr. S, in his note for the Final Hearing, refers to G as my ‘primary concern’. In my judgment that is putting the bar a little high. He is my first consideration and I must consider his welfare before other factors.

38. At the outset of the hearing Mr. S made a late, oral application to adduce two Child Impact Statements that were prepared by the Family Court Advisor Glynnis James pursuant to section 7 of the Children Act 1989 for use in the proceedings in respect of the Child Arrangements of G which were concluded by agreement on 31 August 2021 some three months before the final hearing in these proceedings. I admitted the documents after little objection on behalf of the Husband and read them before the hearing commenced. The first is dated 23 March 2021 and the second 21 July 2021.

39. The reports were of particular relevance to my statutory first consideration. They did not have G’s attachment to the family home as their primary focus but do shed light upon his welfare and emotional attachment to the home independently. They reported that G missed ‘the old house’. That they all (the family) wanted to be around memories of F. It was clear that G wished to return to the home. The July report reads, at paragraph 3.5, “As stated in the (earlier report) he told me that he very much wanted to live where F had lived. It is therefore unsurprising that G feels emotionally challenged when he attends the family home”. His father had, as I have said, remained there.

40. The contents of the report are consistent with the evidence given by the Wife. She said under cross examination by Mr. F, “Do you know the status before we moved out. G started locking himself in the bathroom and said I don’t want to live any more. There was too much tension.” And later she said, when it was put to her that G had been out of the property, “yes but he still has a hope. He pulled himself from dark place with hope of one day I go back to the old house.” Upon re-examination she was asked how G would react if they could not return. She stated, “I can only guess because we went through a lot. If he is getting upset he will go to bed very late and in the morning refuse to get up. He will avoid going to school and he will feel not looking forward to it. We have tried so hard to get him back to school.”. When asked how he would react if he could return to the home she said, “He would jump in joy he would ask me when, he would start planning. He would have so much idea. He already told me he wants to turn E’s room into his computer room. He will be straight on. He planned to get some shelves for the wall. He started looking for furniture already. He assembled his own computer. He wants a shelf to display it on. He wants to replace the curtains. I said no so he would be I can’t imagine how excited he would be. He told me we need to get a gardener. When F wouldn’t go to school we planted a lot of plants. He would be full of joy.”

41. I accept the Wife’s evidence upon this matter. As I have said it is consistent with the reports admitted. I find as a fact that it would advance the welfare of G to return to the family home. Indeed, having read the trial bundle prior to the final hearing and having heard evidence from the parties I explained after the evidence was concluded and before counsel made their closing submission that I considered the question of whether G’s welfare would be served by a return to the property was a question of fact for the court and that in my judgment that it should be achieved if it could be achieved fairly.

42. There are some other issues which arose in respect of the family home and G’s attachment to it and removal from it. Firstly, it is right to say that the Child Impact Statement from July makes clear that the Wife was providing G with information about these proceedings. At paragraph 3.4 the reporter writes that G said “we are willing to lose the car and talked in terms of percentages of the money that could possibly be shared’. As a 11 year old boy at that time it would have been inappropriate for him to have this level of understanding. I cannot therefore rule out that his desire to return to the house is bolstered by his relationship with his mother and her perspective of the case and its issues. The evidence upon the meal at Nando’s which followed a change of heart by the Husband who had previously conceded (in reply to questionnaire and open correspondence) that the Wife and G could remain in the home was conflicting. On the one hand the Wife explained how G reacted when she informed him that they may not return to the family home. I accept her evidence as to his reaction. However, I am also concerned that she did not provide the information to him in a sensitive and positive manner.

43. Secondly, there was a sensible and child focused ‘nesting’ or arrangement put in place by the parents. This entailed G, and perhaps E when necessary, upon his return from University, to remain at the family home with the parents taking it in turns to vacate. When it came time for the Husband to vacate he refused. He admitted as much and explained, under cross examination from Mr. S, “that was what we intended to do. I became concerned I didn’t believe A was acting in good faith I didn’t believe that I would be able to get in to spend time with G. I didn’t have any trust that it would work.” In my judgment that was a mistake. The Husband conceded that the Wife was the primary carer and likely to be in future. His suggestion that the Wife could have left G in the house was unrealistic. I have no doubt that this action by the Husband caused substantial animosity between the parents and unhelpful and avoidable emotional turmoil for G. The Husband took pre-emptive action to a wrong that might well not have resulted to the detriment of G’s welfare at a very difficult time. I do however recognise that the Spring and Summer of 2020 were of themselves extraordinary and not a good time for anyone to be having to make substantial life changes. While the Wife refers to controlling behaviour on the part of the Husband in her statement in support of her application for maintenance pending suit I note that this was conceded by her to some extent in the compromise of the Child Arrangements application as is plain from the face of the order. It is, however, unarguable on any view of the assets schedule above that the Husband substantially controlled the parties’ finances even after 21 years of cohabitation and marriage.

44. Separately, there were two allegations of non-disclosure raised against the Husband in cross examination. Firstly, he had failed to disclose during an earlier application for Maintenance Pending Suit by the Wife, which on the face of the parties’ incomes at final hearing looks to have likely had merit, that he was very imminently, the next month, about to receive his full monthly USS pension income. He was taken to the letter confirming as much dated 16 February 2021 on C134 and then to a number of letters from his solicitor which failed to disclose the fact. His answer was “Either I had overlooked the letter or I had considered that what was written on 5 March was correct at the time”. I find that to be an unsatisfactory answer. He clearly knew that he was going to receive the income and refused to disclose it. Secondly, it became apparent in cross examination that he had an income from the government of £250 per month, to which I will refer in consideration of his income, which had not previously been disclosed. I also find that this was unsatisfactory. In my judgment these were two examples of a failure to provide full and frank disclosure. They might affect credibility but in reality, this is not a fact heavy case, as it was opened to me and I agree, and so the effect of my findings upon them will be very limited.

45. These findings that I make do not reach the standard required for them to have a bearing on the division or the orders that I make as bad conduct on the part of either party as set out in section 25 above. They do, however, qualify as circumstances of the case, to all of which I am bound to have regard. In any event, whatever the complexity of the reasoning behind G’s keen desire to live in the family home I accept that it exists. I further find that the overwhelming reasoning lies more in the terrible loss of his older sister and the largely consequential separation of his parents followed by the loss of his brother from the household to university as well as the contested proceedings that this difficult case has forced upon his parents and its effect upon them and upon him by extension. In light of this history I consider this case to be highly unusual upon its facts. I find that my first consideration under the act has an exaggerated aspect as a result.

46. The Husband’s income is the subject of dispute. Mr. S puts it at £4,516 net at paragraphs 29 and 40 of his note and £69,488 gross per annum. Mr. F gives gross annual figures totalling £69,456. However, the disagreement is upon what the net monthly income received is. Under cross examination by Mr. S it was put to the Husband that he would continue to earn £3,321 net monthly but Mr. F interjected that his figure was £2,758 as per paragraph 49 of his note. On inspection of the document that figure relates to the remaining net income the Husband would receive from his USS pension only if the Wife’s sharing figure of 26.703% was used. Mr. F does not include other sources of income in that figure whereas Mr. S does.

47. In evidence the Husband confirmed that he received £3,350 net monthly from the USS pension as well as state pension income of £718 per month net and income from editing journals of about £700 to £800 per month gross. He later conceded, as I have mentioned, that he received £250 per month from the government for extra work which had not previously, as I understand it, been disclosed. He explained it will cease in 2022. As the amount and term of periodical payments is agreed the precise amount of income received by the Husband in future is of less importance. Quite what work he will undertake during his retirement remains to be seen even by him.

48. The Wife’s income is very limited at present. She made the decision to leave lecturing and write and illustrate in 2018 before F first self-harmed. Sine F’s death she has written a series of books, Mr. Crowley They are referred to as B books and which is the Wife’s pen name. They aim to teach children to think for themselves and stay true to themselves through stories. No doubt the work is as therapeutic for the Wife as it would be for the intended young readership. The Wife has hopes that she can market the books using advertising on Amazon. She wants to make a success of her work. The Husband points to the fact that she relatively recently gave up lecturing in 2018 and, after their separation, must look to secure employment. In my judgment it should be possible for the Wife to pursue her writing and illustrating ambitions, provide care for G and take on part time work. After the parties’ separation she cannot expect to simply rely upon her writing and illustration and income from the Husband. To some extent she clearly accepts this as she asks for 2 years of periodical payments capitalised at £40,000 which is agreed. She puts her income needs at £19,800 per annum at paragraph 16 of her section 25 Statement and so the agreement appears appropriate as to quantum.

49. The Wife also seeks the sum of £50,000 by way of additional lump sum to pay for contingencies, to invest in her business and cover her share of school fees until she is self-sufficient.

50. The parties housing needs are provided for by property particulars in the usual way. There are properties at C089 to C104 showing a range of properties in and around the area of Town Z with three or four bedrooms and marketing prices between £300,000 and £500,000. In evidence in chief the Wife suggested first that the property in Town Z on C94 was most appropriate which is marketed at £350,000. It appeared there was some confusion and that Mr. S had perhaps expected a different answer. The wife did then suggest the property at C97 was more suitable which is at X Road and marketed at £495,000. More property particulars, put forward by the Husband as being suitable to meet both parties’ needs are to be found at D57 to D59. They range from £275,000 to £350,000. They show five properties all of which have two bedrooms. I find that each party should have a property with three bedrooms so that E can stay and G can have a place to keep his computing equipment and that a property of that nature in the appropriate area can be found for £350,000 and that such would meet the needs of each party.

51. I find that the parties’ needs can be met by the equal sharing of the matrimonial property and therefore this is predominantly a sharing case.

Determination and conclusion

52. This is an extraordinary case. If it were not for the tragic death of F, the fallout that understandable resulted and its effect upon G the case would likely not have reached final hearing.

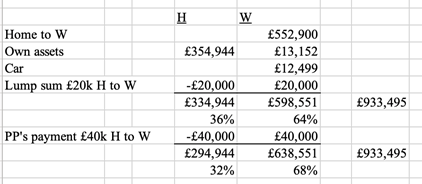

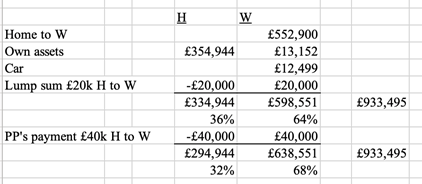

53. The Husband seeks orders that would commonly be agreed. He seeks an equal division of the liquid capital including the family home proceeds upon sale. That would provide each with £466,748 according to the schedule. He proposes a pension share of 36.91% to equalise income in retirement. He agrees a £40,000 payment as capitalised periodical payments which would be taken from his share and paid to the Wife. He concedes a transfer of the car to the Wife and intends, he told me in evidence, to replace it like for like if possible. He also seeks a school fees order that the parties share the cost of G’s private secondary education.

54. It is a straightforward arrangement. In evidence I suggested to the Wife that this would guarantee her equality and that offsetting would not be as certain to provide an equal division. She replied that her retention of the family home for G’s benefit was her aim.

55. The Wife wishes a transfer of the family home from the Husband to her and a reduced pension share of 26.703% using offsetting for tax only on the PAG method as set out in the PODE report. She agrees the £40,000 for periodical payments. She asks for the family car with its agreed value of £12,499. She appears to agree a school fees order but asks for a further lump sum of £50,000 partly in order that she can comply with such an order.

56. I raised, during the parties’ submissions and with each of the advocates the potential middle way of a deferred sale of the family home. I invited them to consider a deferred sale until G finished his GCSE year in 5 years time or his A-levels in 7 years time. Neither party found this potential compromise to be attractive. Mr. F suggested it had been considered but discounted because of the drop in income the Husband would suffer as a result of the 36.91% pension sharing order and the fiscal difficulty he would be under until the determining event. Mr. S turned to his client, and she shook her head in opposition. In my judgment imposing a deferred sale upon Mesher terms against the wishes of both parties is unlikely to lead to a happy and, therefore, suitable outcome. While it seems to me that this could be a reasonable compromise I will not impose it upon them. While I recognise the concern raised many years ago by Munby J, as he then was, in B v B (Mesher Order) [2003] 2 FLR 285 about such orders being often unfair to the party remaining in the home I do not consider this would be such a case because of the ages of the parties, their competing needs and the welfare of G.

57. There is little doubt in my mind that in light of the size of the Husband’s pension a pension offset should be possible to do justice to the Wife’s retention of capital over and above that which she would receive upon an equal division. It was for this reason that I sought further clarification and assistance from the PODE. My remaining concern was and remains that it could be achieved while being fair to both parties.

58. First, I must come to a decision upon capital and income. In respect of income I will reflect the parties agreement. Capital is more difficult. If I concede to the Wife’s request for a lump sum of £50,000 the Husband, who without the family home has £367,368 and £354,869 without the Toyota Yaris. will be left with £264,869. As I have said I put his housing needs at £350,000 and he would need to borrow some £85,000 to meet those. Furthermore, I have found that the Wife must increase her earning capacity in order to achieve financial independence. In the circumstances while I accept that the Wife has a further need above the £40,000 I do not see that £50,000 is justified. This is particularly the case if she retains the majority of the capital by retaining the family home. I consider that to award her a total lump sum of £60,000 would be sufficient and fair. Whether the further £20,000 is seen as a third year of income for her or a capital sum to assist with school fees and her work seems immaterial as the exercise is one of future prediction and so inevitably fallible with the passage of time. For the purposes of considering the partial offset it would be appropriate to consider that £20,000 as capital. I recognise that the Husband will be left with £294,869 if the family home is not sold and will have to borrow around £55,000 to buy a property that meets his needs as assessed by me and defined by him by the property particulars he filed.

59. Then, crucially, I must consider whether a partial offset can be fair. The sum in question is the total of the wife’s capital with the one half of total capital deducted. It becomes £131,803 (£598,551 - £446,748).

Adjustment for tax and / or utility

60. The table at Section 4 a) of the addendum pension report at page E34 (internal page 9) shows that a deduction for tax only on the PAG method would be 0.652% for every £10,000. For every £1,000 I take it that the reduction would therefore be 0.0652% x £131,803 = 8.593%. So the 36.91% would become 28.32%.

61. However, this is plainly in my judgment a case in which a utility adjustment is required. The following factors are set out in the PAG report as being potentially relevant:

7.41 The following observations are not considered to be exhaustive or a checklist, but may assist the court or parties when considering how a utility adjustment may be factored in:

a. With the advent of pension freedoms it is arguable that the utility adjustment has lost its usefulness when considering many Defined Contribution pensions. This is because when pension holders reach 55 they are often able to liquidate their pension funds, subject to tax, converting the fund to cash. A similar argument could also be made in respect of Defined Benefit pensions, which, following professional advice and except for unfunded public service schemes, can be transferred to a Defined Contribution scheme and liquidated in the same way.

b. In ‘needs’ cases it may be harder to see justifications for a ‘utility adjustment’.

c. If the assets are larger and the non-pension holder has income and/or capital beyond their needs, then consideration of what utility adjustment may be appropriate may be more readily defensible.

d. If the pension claimant requires present capital to meet a basic housing need for themselves or minor dependents this would point against any utility adjustment.

e. Conversely, if the pension holder is subject to an offset which results in the permanent loss of owner-occupied accommodation, this might justify the application of a utility adjustment.

f. The closer the parties are to their normal retirement age, the more the justification for a utility adjustment diminishes.

g. Our anecdotal observation is that in many cases pensions appear to have been excessively adjusted for perceived utility.

h. There is an argument that the recipient of an offset is at a long-term disadvantage to the pension member, rather than an advantage, by not having the equivalent amount of pension fund.

i. None of the forgoing considerations should operate to prevent fair and pragmatic overall settlements being arrived at.

62. I do not consider that a. is particularly relevant here as the expert evidence points to retention of the pension credit received by the Wife within the USS scheme as being most beneficial. While this is a needs case the Husband’s needs would be met by not only his remaining capital but also his remaining income. The Wife’s needs would be met by her retention of the family home and her ability to increase her earning capacity. She is 14 years younger than the Husband which gives her greater ability to improve her position.

63. Whereas it is right that in this case the family home would present a basic housing need for the Wife and G it far exceeds the Wife’s needs being a 6 bedroom property with a value of £570,000 whereas I have assessed the parties housing needs each at around £350,000. It therefore exceeds her needs considerably and she would be left in it solely because of the very particular circumstances of this case. In my judgment that is a strong factor militating towards a substantial adjustment for utility.

64. Allied to that point the Wife would have the ability to sell the property when she believes a sale would be suitable. That gives her a substantial advantage in my judgment. G will reach majority in 6 years time and leave school in 7. She could access those funds within that sort of time scale if she so chose.

65. In regard to point e. the Husband would have capital of £294,869 after payment of the £60,000 lump sum. That would go a long way towards meeting his housing needs as assessed. He would be required to mortgage to meet those needs with a small mortgage that would be affordable with his greater remaining income.

66. The Wife is 52 and her normal retirement age from the USS scheme is 65 years old. The early retirement actuarial reduction is fairly substantial. She cannot claim her pension credit within the scheme until the age of 60. The pension sharing report is based upon the assumption that she will work until 65. In my judgment this would be further reason to adjust for utility.

67. Allied to his is the fact that this is an income gap case. The Husband’s income would reduce upon implementation of the pension sharing order. The Wife’s pension would not be received by her until 65 without reduction or 55 and 60, as identified by the PODE. This is yet further argument for a utility adjustment.

68. As for the Wife recipient being at a long term disadvantage Mr. F rightly and astutely draws my attention to the net effect of the reduced pension sharing order upon the parties set out at page 5 of the addendum report on E30. For every 1% reduction the PODE tells me, as I have said, that the Husband would lose £587 per annum and the Wife would gain £690 per annum. This fact which is provided in the report, and I therefore accept, has in my judgment, a considerable effect upon what might be fair as to adjustment for utility as I will explain.

69. The PODE uses an averaging method with which I am not familiar and in his addendum report gives percentage reductions when considering all benefits for each £10,000 of 1.076 % for 40% for utility and tax and 0.646% for 0% of either. For the PAG method of using the full value only he starts with a total offset figure for tax only of £564,690 (at E40 of the addendum) but this became £565,690 in the table he produced in his email of 26 November 2021. This might have been explained by him in that email when he wrote “After £100,000, there is distortion in reconciling the extremes (all offsetting vs all sharing)”.

70. For a full 40% adjustment for tax and utility using the PAG method he provided a starting total offset figure of £404,221 using the following formula (equals 565,221*(1-.4)/(1-0.16033). Using that schedule a full tax and utility adjustment of £131,803 would be between 24.606% and 25.254%. Proportionately using a straight line approach it would appear to be 24.87%.

71. Using the figures given for The PODE’s averaging approach and again proportionately and using a straight line the percentage to offset £131,803 would appear to be 22.73% (using 1.076% reduction for each £10,000 so a percentage reduction from the 36.91% of 14.18%).

72. These are therefore the figures provided by the PODE to account for a 40% reduction. I am satisfied that this full adjustment, at least, is justified in this case for the reasons given at paragraphs 62 to 68 above.

73. If I were to choose between the two approaches I would prefer the PAG method because of the unconventional nature of The PODE’s approach.

74. However, if I then look at the effect of these types of adjustments upon the Husband, in order to ensure that I am doing justice and achieving a fair result I note that the PAG method reduction of 12.04% (from the 36.91% required for equal income in retirement to the 24.87% deduced from the table for a partial offset at 40% for tax and utility adjustment provided by the PODE) would provide him with £7,067.48 gross income per year based on the figure of £587 for every 1%. He would have to receive that income for 18.65 years in order to recover it. He would have to pay tax upon it (if it were, as it would be, upon his remaining pension income). ONS life expectancy figures in At a Glance put his life expectancy at 19.3 years. In my judgment that is not a fair result.

75. Necessarily therefore, having come to the conclusion that I have as regards the retention of the home by the Wife I must adjust the partial offset beyond the 40% proposed in the PAG report. I pay particular attention to the words “The suggested parameters of 20% to 40% are not intended in any way to be a straightjacket to judicial discretion but may often assist in reaching an outcome in the appropriate parish” at 7.31 of the report.

76. In my judgment the Husband must have the opportunity to not only recover the capital that he is not receiving now but also to be compensated for having to wait for it as future income which will be received monthly and taxed at marginal income rates. At the age of 66 I would think that the money should be recovered within a shorter period. I have considered the ramifications of a number of percentage reductions from the 36.91% rate and have seen that an order for 18% would provide a further £11,100 (18.91% x £587) to the Husband per annum taking nearly 12 years to recover the amount lost. 20% would provide £9,926 (16.91% x £587) per annum and would take over 13 years to recover.

77. In light of the particular circumstances of this case precipitated by the awful tragedy which dominates I do propose to transfer the family home to the Wife in return for a partial offset of her rightful pension sharing order to receive equal income in retirement based upon all accrual of pension rights. I recognise that the Husband conceded such in answers to questionnaire, in an open offer dated 12 August 2021 and in an open offer dated 18 November 2021. That last letter and the Cafcass reports I was provided in hard copy were the only paper documents I have received in the case a fact of which I am grateful. The Husband’s open offer of 18 November 2021 was for a 10% pension share. That in my judgment and in light of my considerations above as to adjustment for utility and taxation is too great a reduction.

78. I am satisfied that this case is one of a minority of cases in which offsetting other than by consent is appropriate. The difference between this case, in which there is capital of £933,495, and W v H in which the capital available was only £241,782 less the parties’ substantial debts is stark. The unusual facts of this case support partial offsetting in order to achieve a fair result upon undertaking the section 25 exercise.

79. My conclusion when balancing the various factors that I have referred to above is that a pension share in favour of the Wife reduced so that it does justice to the extra capital she will receive is 18%. The Husband will receive that amount of capital in gross income over the next 12 years at £587 per 1% per year. At £690 per 1% per year the Wife is having ten years of gross retirement income immediately to provide a home for herself and G.

80. So, I will order:

d. A transfer of the family home from Husband to Wife;

e. A pension sharing order in favour of the Wife against the Husband’s USS pension scheme as to 18% with the cost of implementation shared equally;

f. A lump sum of £60,000 representing £40,000 for income (left out of account in my capital considerations for partial offsetting) and £20,000 as capital (included in those calculations);

g. A transfer of the family car to the Wife (included within her capital for calculations); and

h. Clean breaks.

81. I will not make a school fees order. It follows from my decision that I concluded that the Husband could not afford to pay more than the sum I have ordered by lump sum to the wife. It would then seem illogical to order that she pay half of the school fees. I will leave it to the parents to decide between them, with G’s interests at heart, whether they can between them continue to afford his private education in future.

82. It is, of course, a matter for the parties whether, having digested my judgment, they wish to come to an alternative agreement. I would be open to considering an alternative or amendment to my decision if it were agreed. That might be a deferred sale or it might be an immediate sale. In my judgment, however, on this case as brought before me this conclusion is a fair one when applying the law to the facts of this case.

83. A direction was made that any application for costs be made in writing by 15 December 2021 a week from today. In view of the parties’ open positions and the apparent lack of litigation misconduct I doubt they will be made. The directions also provided for an agreed order to be filed by 23 December 2021. If no submissions upon costs are filed I will direct that order by 4pm on 16 December 2021.