Mr Nicholas Thompsell:

1. BACKGROUND

- In the early years of this century, Northern Rock PLC ("Northern Rock") offered what seemed to be highly attractive mortgage packages. These included attractive fixed rates and a high loan-to-value ratio for the mortgage loan. For some of its customers the offer was made yet more tempting under the so-named "Together" offers. These offered a package comprising a mortgage loan (the "Together Mortgage") alongside an unsecured loan (the "Together Loan") offered at the same interest rate, but with that rate being available on condition that the mortgage loan was kept in existence by the borrower. By taking both loans, some borrowers were able to borrow more than the assessed value of the property that was mortgaged.

- There was a catch, of course. After an introductory period, usually of a small number of years, the fixed rate would move up to a (generally) higher floating rate or, in some versions of the mortgage offers, at a discount to this rate (the "SVR", the definition of which is discussed further below).

- The attention of the mortgage customers was clearly drawn to this feature of the loans. There was a suggestion that the impact of this may have been softened by Northern Rock's marketing literature which suggested that, before applying the SVR, Northern Rock would expect to offer a new fixed rate, but this was not the subject of evidence and I make not finding on this matter.

- Unfortunately for both the shareholders and customers of Northern Rock, Northern Rock proved to be one of the early casualties of the global financial crisis of 2008. In February 2008, Northern Rock was nationalised, with its entire issued share capital being transferred to HM Treasury. Following the implementation of a restructuring plan in 2010, Northern Rock was transferred to UK Asset Resolution Ltd, a wholly owned subsidiary of HM Treasury, and ceased to operate as an active lender. Northern Rock was subsequently transferred to an affiliate of Cerberus Capital Management, and later, in July 2016, a portfolio of the mortgages still held by Northern Rock was transferred to the Defendant, TSB Bank PLC ("TSB").

- TSB has operated these mortgages under what it calls its "Whistletree" brand and I will adopt TSB's terminology in referring to these mortgages as the "Whistletree mortgages".

- The SVR, as I am calling it, was defined in different editions of Northern Rock's Mortgage Offer General Conditions (the "General Conditions") as the "Standard Variable Rate" or as the "Standard Variable Mortgage Base Rate" but, as discussed below, these terms are defined in almost exactly the same way in each edition of the General Conditions. Within this judgment I will use the term "SVR" to refer to either such defined term, except where I am drawing a distinction between the two defined terms.

- At the time when TSB acquired the Whistletree mortgages in July 2016, the SVR that was being applied to the Whistletree mortgages was 4.79%, which was 4.29% above the Bank of England's Base Rate (the "BoE Base Rate") at that time. Following its acquisition of the mortgages, TSB has subsequently varied this variable rate from time to time, both up and down and, in each case, consistently with changes to the BoE Base Rate.

- TSB also maintains and applies other standard variable rates to different categories of variable-rate mortgages. These other standard variable rates include:

i) its "Homeowner Variable Rate" ("TSB's HVR"), which is the rate being advertised and used for new mortgage loans;

ii) its "Standard Variable Mortgage Rate" ("TSB's SVMR"), which is a rate that is applied to a portfolio of variable rate residential mortgages applied for before 1 June 2010 (which I understand to be mortgages TSB acquired from Lloyds Bank); and

iii) a Buy to Let Variable Rate.

- The Claimants in this action are some 392 former mortgage customers of Northern Rock whose mortgages and/or loans were transferred to TSB (or are alleged to have been so transferred – TSB claims that it has not verified that all of these Claimants are, or were, its customers). They are undertaking a group legal action against TSB. I understand that there are a further 2,000 or so mortgage customers who are in a similar position that have intimated claims against TSB and have entered into a standstill agreement with TSB pending the outcome of this group litigation, or at least of the preliminary issues that I am dealing with in this judgment.

- These Claimants regard themselves as being (or as having been) "mortgage prisoners" in that they are (or were) trapped into paying an unduly high variable rate on their mortgages.

- TSB challenges this description, pointing out first that a very substantial percentage of the former Northern Rock customers have been able to remortgage and obtain the benefit of lower rates and secondly that the court does not have the evidence before it to determine whether the former Northern Rock customers are mortgage prisoners.

- Nothing turns on the description, as regards the matters before me, and there has been little evidence or argument on the point. Accordingly, I will resist offering my own opinion on the aptness of this description, acknowledging that the point is best determined by a court that has all the evidence before it.

- The Claimants are seeking a number of remedies including:

i) damages for breach of the express and/or implied terms of the mortgage contracts; and/or for breach of the rules in the FCA's Mortgages Conduct of Business Sourcebook ("MCOBS"); and/or

ii) declarations as to the rate of interest chargeable by TSB under the terms of the mortgage contracts; and/or

iii) accounts as at the date of trial of all sums wrongly paid to TSB with orders for payment by TSB of all such sums found to be due on the taking of the account; and/or

iv) as regards Claimants whose mortgage contracts were entered into by them before 31 October 2004 and Claimants who had taken out the Together loans, a declaration that the relationship between each of such Claimants and TSB and/or Northern Rock was and/or is unfair within the meaning set out in section 140A Consumer Credit Act 1974 (the "CCA 1974"); and an order to repay such sums as would redress that unfairness; and

v) interest under section 35A of the Senior Courts Act 1981; further or other relief; and/or costs.

2. THE PRELIMINARY ISSUES

- It was not, however the purpose of the trial of preliminary issues before me to determine these claims. The purpose was to determine, originally, three preliminary issues which may be summarised, and to which I have assigned labels, as follows:

i) The "Express Terms issue". This is the question whether TSB has breached the express terms of the Claimants' mortgage contracts by charging the Claimants interest rates based on what TSB describes as the "Whistletree SVR" and not on the TSB SVMR.

ii) The "Implied Term issue". This is the question whether, as argued by the Claimants:

"it is an implied term of the Claimants' mortgage contracts that any discretion to set and/or vary interest rates should not be exercised dishonestly, for improper purpose, capriciously, or in a way in which no reasonable mortgagee, having the relevant discretion and in the context of the parties' expectations, acting reasonably, would do".

and

iii) The "CCA issue": This is the question whether s.140A(5) CCA 1974 precludes an order being made under s.140B(1) in relation to a regulated mortgage contract or quantified by reference to sums payable under a regulated mortgage contract, irrespective of whether that regulated mortgage contract is the "credit agreement" or a "related agreement".

- Deputy Master Hansen had ordered that these three preliminary issues should be determined before a trial of the remainder of the issues arising as a result of the Claimants' claim. I agree with the learned Deputy Master that this was a sensible approach as the determination of these issues should greatly cut down the time required for trial of the remaining issues.

- For the purposes of the trial of the preliminary issues, the parties have helpfully agreed a Statement of Agreed Facts that I should assume to be correct. I should emphasise that this document was produced purely for these purposes, and in relying on the Statement of Agreed Facts, I am not making any determination of those facts. In particular some of the facts assumed may or may not be correct in relation to particular mortgage customers and in relying on these assumed facts I should not be taken as having determined any of these facts has been true in relation to any particular mortgage customer.

3. THE IMPLIED TERM ISSUE

- Shortly before the trial of these preliminary issues started the parties agreed a resolution in relation to the Implied Term issue. They agreed that an implied term did apply as follows:

"It is an implied term of the Claimants' mortgage contracts that the discretion to vary interest rates should not be exercised dishonestly, for improper purpose, capriciously, arbitrarily or in a way in which no reasonable mortgagee, acting reasonably, would do."

- In other words, TSB has accepted the Claimants' proposed wording subject to deletion of the phrase "and in the context of the Parties expectations".

- The wording as so amended conforms with that approved by the Court of Appeal in Paragon Finance v Nash [2002] 1WLR 94 and I agree that the parties were sensible in agreeing upon this point.

- The question whether there has been any breach of such an implied term is not one for me to determine. It will fall for determination at a later stage of the proceedings.

- The other two preliminary issues remain outstanding, and I determined that I should hear from the parties in relation to these issues in turn.

4. INTRODUCING THE EXPRESS TERMS ISSUE

- The Mortgage Offers required mortgage loans, after a period during which a fixed rate or tracker rate would apply, to bear interest at the SVR.

- By the time that TSB acquired the relevant mortgage loan portfolio, all or the vast majority of, the loans comprised in the portfolio had moved onto the SVR. On obtaining the loan book, TSB initially continued to charge such borrowers interest at the same rate that they had been charged previously, referring to this as the "Whistletree SVR" (reflecting the fact that for marketing purposes they were referring to the former Northern Rock borrowers as their "Whistletree borrowers"). TSB later moved the interest rate up and down in a manner that matched changes in the BoE Base Rate.

- The Claimants argue that they were wrong to do this. They argue that under the General Conditions TSB had a choice either to keep the rate as it was or to move it to TSB's own standard variable rate, being the rate that it used for its other customers. In fact, TSB had more than one such rate. In such circumstances the Claimants argue that TSB should use the most relevant rate, being the one that had been used for mortgage customers who had taken out their mortgage in a similar timeframe to the former Northern Rock customers.

- The SVR was defined in the General Conditions, and I will deal in more detail with the definition below. However, to introduce the point, it is only necessary to note that the core element of the definition is:

"… such rate as we from time to time decide to set as the base from which to calculate Interest on our variable rate mortgage loans…".

- This definition was easy to apply when Northern Rock remained the mortgage lender. The dispute as to the meaning arises once the mortgage loans were transferred to another lender, TSB.

- Such a transfer was envisaged within the General Conditions. In particular there is in condition 1.1 of the General Conditions a definition of "we", "us" and "our". I will refer to this as the "definition of "we"".

- Under the definition of "we" these words are said to refer to:

"… Northern Rock plc and anyone who becomes entitled at law or in equity to any of our rights under the Offer (this will include any person to whom we transfer the Offer under condition 19)".

- In other words, once there is a transfer, references to "we" and like terms in the definition of SVR, become references to (both) the transferring mortgage lender (originally Northern Rock) and the transferee mortgage lender (now TSB).

- This formulation is difficult to apply to the definition of SVR.

- If we take the formulation literally, and assume that the word "and" within the definition of "us" must always be read conjunctively, then the definition becomes (in the applicable circumstances):

"… such rate as [Northern Rock and TSB] from time to time decide to set as the base from which to calculate Interest on [Northern Rock and TSB's] variable rate mortgage loans…".

- Under such a literal reading, the SVR would exist only for so long as the outgoing lender and the incoming lender each continued to set the same particular interest rate as the base from which to calculate interest on their respective variable rate loans. As soon as one or the other set a different interest rate then there would be no such rate that met the description I have set out in the previous paragraph.

- Furthermore, as we shall see when we come to consider other parts of the Mortgage Conditions, there are other places where the strict, conjunctive, use of the word "and" within the definition of "we" would make a nonsense of the drafting.

- As the strict, conjunctive, use of the word "and" within the definition of "we" was unworkable, both the Claimants and TSB accepted that, where the circumstances require, the definition of "we" should be read disjunctively, so that the word "and" meant "and/or", so as to connote a reference either to the outgoing mortgage lender or the incoming mortgage lender as the sense requires. They differed, however, on how to apply this analysis in practice.

(i) The Defendant's interpretation of the core of the definition of SVR

- The Defendant's interpretation was, in my view, the simplest and most straightforward.

- The Defendant argued that up to the point of transfer "we", "our", and "us" referred to the outgoing mortgage lender (i.e. Northern Rock) and after the point of transfer it referred generally to the incoming mortgage lender (i.e. TSB). There was, perhaps, a period during which the rate being applied had been the one originally set by the previous lender (Northern Rock) and had not yet been set differently by the incoming lender (in our case, TSB). During this period, it would be correct to say that that rate had been set by the previous lender and the incoming lender, since the rate would have been originally set by the outgoing lender, and until it was changed by the incoming lender, the incoming lender must be taken to have accepted that rate as the appropriate rate and therefore in a sense itself to have set that rate.

- It was TSB's submission, however, that this analysis did not mean, in relation to the definition of SVR, there was an automatic transfer to another rate that TSB was using in relation to its other loans. This was because the definition of SVR was referring only to the rate used to calculate interest on mortgages that were subject to the General Conditions. Any rate used to determine interest on loans that were made under different terms and conditions was not relevant.

- TSB had a textual argument to back up this interpretation based on the definition of SVR. The definition of SVR, where it referred to "Interest" was referring to a defined term in condition 1.2.

- In the 2005 version of the General Conditions "Interest" was defined as

"… interest we charge under Condition 6 at the Interest Rate".

- In other words, it is interest that is charged under a particular Condition within the General Conditions. TSB argues that, given this specific reference, the definition of SVR must be applying to the rate charged to mortgages that are subject to the General Conditions, and not to any rate that the lender (now TSB) was applying under different terms and conditions.

- Mr Lord, for the Claimants, pointed out that the 2001 General Conditions included slightly different wording on this point.

- First it used the term "Standard Variable Mortgage Base Rate", rather than "SVR". Neither side contends that this difference in nomenclature makes any difference to the analysis.

- More importantly in relation to TSB's argument as outlined above, whilst the definition of "Standard Variable Mortgage Base Rate" is in the same terms as that I have outlined above. It also uses the capitalised term "Interest", but, the definition of "Interest" is different. In this edition of the General Conditions, it means "interest at the Interest Rate" and contains no reference itself to Condition 6.

- However, when one turns to the definition of "Interest Rate", this is defined as:

"the rate or rates of interest we charge under Condition 6".

- As a result, I do not consider that these differences in the defined terms weaken the Defendant's textual argument as outlined above: the definition of "Interest", taken with the definition of "Interest Rate" still takes the reader to a specific reference to Condition 6, and therefore still bolsters an argument that the definition of Standard Variable Mortgage Base Rate in this edition of the General Conditions may be taken as a reference to an interest rate determined for the purposes of mortgages that are subject to the General Conditions.

- It might be said that it follows from this argument that the SVR is logically a different rate for the mortgages under each different edition of the General Conditions, but if that is true nothing really turns on the argument. Northern Rock and its successor have consistently applied the same rate for the SVR across all mortgages to which any edition of the General Conditions applies and given that the parties accept that there are no material differences between the different editions of the General Conditions, there has been no reason to apply different SVRs to the mortgages issued under different editions.

(ii) The Claimants' interpretation of the core of the definition of SVR

- The Claimants argued for a different interpretation. They agreed that up to the point of transfer "we", "our" and "us" referred to the outgoing mortgage lender and after the point of transfer it referred generally to the incoming mortgage lender (i.e. now TSB). However, they set greater store on the point that under the General Conditions there was a transitional period during which the rate being applied had been the one originally set by the previous lender (Northern Rock) and had not yet been set differently by the incoming lender (in our case, TSB). In their submission, during this period it might be correct that the rate remained one that was set by the outgoing mortgage lender and TSB. However, at the point that TSB changed the rate applicable to these customers, then the conjunctive use of "and" meant that it was no longer sustainable to say that what TSB was applying was a rate "set by the previous mortgage lender and TSB". At this point the reference to "SVR" must be taken as a reference to the standard variable rate applied by TSB across all of its mortgage customers, or if (as is in fact the case) there is more than one such rate, the most appropriate of such rates.

- The net result of this analysis was that if TSB purported to change the interest rate being charged to the former Northern Rock customers, it was obliged to bring those customers onto its own standard variable rate.

- Both sides assembled a number of arguments based on the text of the General Conditions. Having set the scene as to the overall argument being pursued by each side, it is appropriate that I set out more fully the relevant sections of the General Conditions, as well as of one or two samples of the Offer Letters.

- For these purposes, I will draw on the 2001 version of the General Conditions. It was agreed by both sides that the 2005 version of the General Conditions (the only other version that I was asked to consider) did not differ significantly, except perhaps in relation to the definitions around the term "Interest" that I have already dealt with.

5. THE TERMS OF OFFERS AND OF THE GENERAL CONDITIONS

- The mortgage contracts comprise: (i) a letter offering the Claimants a mortgage (the "Offer Letter"); (ii) the General Conditions; and (iii) an Offer of Loan Acceptance Form. The Claimants' mortgages are, depending on when they were taken out, on the 2001, 2004 or 2005 General Conditions.

(i) Sample Terms of Offers

- I was taken to various letters setting out the Offers made to different mortgage customers, in particular – a sample Offer Letter from April 2004, and sample Offer Letters from 2005 and 2006.

- The Offer Letter was a relatively brief document, which set out the basic terms of the mortgage contract, such as the amount of the loan, its term, and the initial interest rate payable. Its format appears to have changed between 2004 and 2005, but it was common ground that nothing turns on this for the purposes of the matters that I was considering.

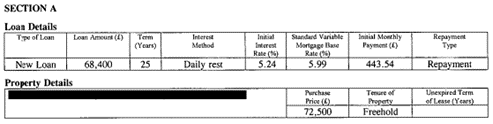

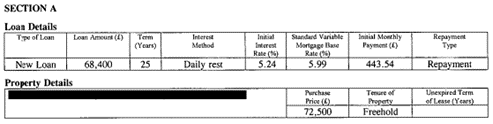

- The key term of each Offer Letter for present purposes was that concerning interest. In the 2004 Offer Letter, Section A of the letter appeared as follows:

- There followed a Section B, which set out "Special Conditions".

- Condition 10 set out the future interest payable (the text quoted below is a sample based on a "Together" mortgage, which had a Tracker Special Rate):

"Whilst your Mortgage Payments are not in arrears by two or more months, the Initial Rate of Interest charged will be guaranteed to be no more than Bank of England Base Rate plus 1.24% until 01/05/2006 and then guaranteed to be no more than Bank of England Base Rate plus 1.85% until 01/05/2009 (the Special Rate Period).

…

On expiry of the Special Rate Period the rate will be set at a rate guaranteed to be below our prevailing Standard Variable Mortgage Base Rate set by us from time to time for existing Northern Rock borrowers (the Guaranteed Rate). We will review the Guaranteed Rate on the 1st of each month following any change in the Standard Variable Mortgage Base Rate…"

- The later variants of the Offer Letter consolidated these provisions in a single section, Section 4, headed "Description of this mortgage", as follows

"This is a Northern Rock product

This mortgage consists of the following parts:

| Loan Part |

Loan Amount |

Repayment method |

Term |

Product |

Initial Rate Payable |

| 1 |

£152,720.00 |

Repayment |

35 years |

Together 3 Year Fixed |

5.99% |

This secured mortgage is based on the following interest rate periods:

• a fixed rate of 5.99% until 1 October 2008

Followed by

• a variable rate which is guaranteed to be below Northern Rock Standard Variable Rate, which is currently 6.59%, for the remainder of the term of the mortgage. Please note that the payments illustrated for this period, are based on Northern Rock's Standard Variable Rate."

(ii) The General Conditions

- I will set out in full the parts of the General Conditions which are relevant to the argument. The following is based on the 2001 edition of the General Conditions.

- Condition 1.1(a) reads as follows:

"In these General Conditions and in the Offer "we", "us" and "our" refer to Northern Rock plc and anyone who becomes entitled at law or in equity to any of our rights under the Offer (this will include any person to whom we transfer the Offer under condition 19)".

- The following definitions appear within Condition 1.2

i) ""Interest" means interest at the Interest Rate."

ii) ""Interest Rate" means the rate or rates of interest we charge under Condition 6."

iii) ""Special Rate" means the rate of interest which is payable on a Special Rate Loan during the Special Rate Period for that Special Rate Loan."

iv) ""Special Rate Loan" means a Loan which is stated in the Special Conditions to be a Special Rate Loan…"

v) ""Special Rate Period" means, in relation to any Special Rate Loan, the period stated in the Special Conditions to be the Special Rate Period for that Special Rate Loan…""

vi) ""Standard Variable Mortgage Base Rate" [the term used in the 2001 Condition for the SVR] means such rate as we from time to time decide to set as the base from which to calculate Interest on our variable rate mortgage loans (disregarding the restrictions on what we can charge under condition 7 or Section B of the Offer)… If we transfer or dispose of the Offer, the person to whom we make the transfer may change the rate to its own base rate which it applies to its variable rate mortgage loans. That rate will then be the Standard Variable Mortgage Base Rate under the Offer and the person to whom we make the transfer may make further changes to that rate under condition 7 or Section B of the Offer."

[Note: the 2001 edition of the General Conditions used the term "Standard Variable Mortgage Base Rate" and the other editions used the term "Standard Variable Rate" but, subject to immaterial differences, both terms are defined in the same way in each edition of the General Conditions.]

- Condition 6 addressed the mechanics of calculation of the Interest Rate. Condition 6.6 in particular provided as follows:

"6.6. If a Loan is a Special Rate Loan (the Special Conditions will indicate if a Loan is a Special Rate Loan), we are not obliged to renew or extend the Special Rate Period unless the Special Conditions makes it a term of that Loan that the Special Rate Period will be renewed or extended."

- Condition 7 concerned changes in the Interest Rate, and provided in Condition 7.1 as follows:

"7.1 We may reduce the Standard Variable Mortgage Base Rate at any time.

7.2 We may increase the Standard Variable Mortgage Base Rate at any time if one or more of the following reasons applies:

(a) There has been, or we reasonably expect there to be in the near future, a general trend to increase interest rates on mortgages generally or mortgages similar to yours;

(b) For good commercial reasons, we need to fund an increase in the interest rates we pay to our own funders;

(c) We wish to adjust our interest rate structure to maintain a prudent level of profitability;

(d) There has been, or we reasonably expect there to be in the near future, a general increase in the risk of shortfalls on the accounts of mortgage borrowers (whether generally or mortgage borrowers only), or mortgage borrowers (whether generally or our mortgage borrowers only) whose accounts are similar to yours;

(e) Our administrative costs have increased or are likely to do so in the near future."

- Condition 19 specifically addresses the setting of the SVR following a transfer of the mortgage contract as follows:

"19.1 We may transfer or charge or otherwise dispose of the Offer or any of our rights under the Offer (including the right to set the Interest Rate) to any person at any time at law or in equity without your consent. Where we transfer to any person the right to set the Interest Rate and we have set the Interest Rate by reference to the Standard Variable Mortgage Base Rate, that person may set the interest charged under the Offer by reference to that person's own (or one of its own) standard variable rates.

19.2 On any transfer of the Offer, we as transferor will enter into an agreement with the person to whom we transfer the Offer (the "Transferee") under which:

(a) we will continue to conduct arrears cases as the agent of the Transferee;

(b) the Transferee will agree that its policy on handling arrears and exercising any discretion in the settling of Interest Rates will be identical to our policy as at the date of transfer.

The agreement will apply for a minimum of three months after the transfer but may be terminated earlier by the Transferee if our performance as agent is not satisfactory or if we suffer financial difficulties or if we breached the agreement. We may terminate the agreement earlier if the Transferee suffers financial difficulties or breaches this agreement. When the agreement comes to an end or is terminated, we may no longer have the right to continue to conduct arrears cases and the Transferee may set its own policy on handling arrears and exercising any discretion in the setting of Interest Rates."

- The Claimants' counsel provided the following background to Condition 19.2. Prior to the advent of mortgage regulation in 2004, the Council of Mortgage Lenders (now UK Finance) published a Statement of Practice on the Transfer of Mortgages (the "Statement of Practice"). A lender within the Council could not transfer a residential mortgage to a lender outside the Council without obtaining the borrower's consent in accordance with the Statement of Practice. The effect of Paragraph 4 and Note 2 in the Statement of Practice was that a borrower could only transfer the mortgage under a "general consent" if the transfer agreement specified that the transferee's policy in exercising any discretion in setting of mortgage interest rates would be identical to that of the original lender. In other words, the purpose of the term was to protect a borrower from harsher treatment in the exercise of discretions as regards the setting of rates.

- Condition 22. Finally, I should mention Condition 22 which provides as follows:

"If their terms are in conflict, the Special Conditions prevail over the General Conditions".

6. PRINCIPLES OF CONTRACTUAL INTERPRETATION

- Before returning to the analysis of the terms of the Offers and of the General Conditions, it is useful for me to outline the principles of interpretation that should be applied when undertaking such an analysis. There was little disagreement between the parties as to what these were.

- The Claimants referred me to the authoritative statement in Wood v Capita Insurance Services Ltd [2017] AC 1173 at [10]-[13] by Lord Hodge. It is worthwhile quoting from the following passages at [10] and [12] in full:

"10. The court's task is to ascertain the objective meaning of the language which the parties have chosen to express their agreement. It has long been accepted that this is not a literalist exercise focused solely on a parsing of the wording of the particular clause but that the court must consider the contract as a whole and, depending on the nature, formality and quality of drafting of the contract, give more or less weight to elements of the wider context in reaching its view as to that objective meaning."

…..

"12. This unitary exercise involves an iterative process by which each suggested interpretation is checked against the provisions of the contract and its commercial consequences are investigated... To my mind once one has read the language in dispute and the relevant parts of the contract that provide its context, it does not matter whether the more detailed analysis commences with the factual background and the implications of rival constructions or a close examination of the relevant language in the contract, so long as the court balances the indications given by each."

- The Defendant drew my attention to a further convenient summary of general principles given by HHJ Pelling at first instance and adopted and endorsed by the Court of Appeal in Lamesa Investments Ltd v Cynergy Bank Ltd [2020] EWCA Civ 821 at [18] and in particular to the following relevant passages within that paragraph (which I have further condensed by removing the citations justifying the various conclusions):

"i) The court construes the relevant words of a contract in their documentary, factual and commercial context, assessed in the light of (i) the natural and ordinary meaning of the provision being construed, (ii) any other relevant provisions of the contract being construed, (iii) the overall purpose of the provision being construed and the contract or order in which it is contained, (iv) the facts and circumstances known or assumed by the parties at the time that the document was executed, and (v) commercial common sense, but (vi) disregarding subjective evidence of any party's intentions …;

….

iv) Where the parties have used unambiguous language, the court must apply it…;

v) Where the language used by the parties is unclear the court can properly depart from its natural meaning where the context suggests that an alternative meaning more accurately reflects what a reasonable person with the parties' actual and presumed knowledge would conclude the parties had meant by the language they used but that does not justify the court searching for drafting infelicities in order to facilitate a departure from the natural meaning of the language used …;

vi) If there are two possible constructions, the court is entitled to prefer the construction which is consistent with business common sense and to reject the other …but commercial common sense is relevant only to the extent of how matters would have been perceived by reasonable people in the position of the parties, as at the date that the contract was made;

…

and

viii) A court should not reject the natural meaning of a provision as correct simply because it appears to be a very imprudent term for one of the parties to have agreed, even ignoring the benefit of wisdom of hindsight, because it is not the function of a court when interpreting an agreement to relieve a party from a bad bargain …"

- The Defendant's counsel also referred me to Lord Miller's speech in AIB Group (UK) Plc v Martin [2001] UKHL 63 at [7] which emphasised the primacy of the words in the case of a standard form, such as mortgage terms, designed for use in a variety of different circumstances. In such cases the relevance of the factual background of a particular case to its interpretation is necessarily limited.

- A further point to note is that the mortgage documentation represented Northern Rock's standard form contract and there was no or very little ability for an individual mortgage borrower to amend the terms of the Offer, and no opportunity to vary the General Conditions. As such, it is appropriate that the documentation should be read contra proferentem, meaning that if there is any ambiguity the preferred meaning should be the one that works against the interests of the party who provided the wording and in favour of the other party.

- It was assumed for the purposes of this trial that at least some of the Claimants were consumers within the meaning of regulation 3 of the Unfair Terms in Consumer Contracts Regulations 1999 (the "UTCCRs"). To be clear, however, I make no finding on this point as this is outside the scope of the preliminary issues that are before me. Insofar as they were consumers, the UTCCRs provides a further gloss on interpretation. The UTCCRs continue to apply despite their revocation by the Consumer Rights Act 2015 because the mortgage contracts were entered into prior to 1st October 2015.

- Pursuant to Regulation 7(1) of the UTCCRs, Northern Rock was obliged to ensure that the terms of the mortgage contracts were "expressed in plain, intelligible language". Regulation 7(2) provides that, if:

"there is doubt about the meaning of a written term, the interpretation which is most favourable to the consumer shall prevail".

- This point probably adds little to the contra proferentem rule that I have already outlined. For both reasons, I consider that the court should, where there is ambiguity, apply the interpretation that is most favourable to the mortgage borrowers.

- However, in doing so it is important to remember two things:

i) these rules of interpretation only apply where the court finds that there is an actual ambiguity that needs to be resolved: see for example in Direct Travel Insurance v McGeown [2004] 1 All ER (Comm) 609, where Auld LJ warned at [13]:

"A court should be wary of starting its analysis by finding an ambiguity by reference to the words in question looked at on their own. And it should not, in any event, on such a finding, move straight to the contra proferentem rule without first looking at the context and, where appropriate, permissible aids to identifying the purpose of the commercial document of which the words form part. Too early recourse to the contra proferentem rule runs the danger of 'creating' an ambiguity where there is none";

and

ii) that the court should not judge the matter with the benefit of hindsight: the position should be considered in the context of the position of the parties as it was when the mortgage loans were agreed, and not having any regard to information which became available only later, such as the fact that TSB became the mortgage lender in succession to Northern Rock or the fact that TSB happened to offer its mortgage customers (or at least some of them) variable rates that were substantially below the SVR that applied to the former Northern Rock loans at the point of transfer.

7. THE CLAIMANTS' ARGUMENT ON INTERPRETATION

- I have sketched out above the core of the argument made by the Claimants, and I will now seek to outline this in more detail. I should point out in doing so that I think that the Claimants' argument developed in oral argument over the course of the trial of preliminary issues and I am not sure that it remained precisely the same as that set out in the Claimants' skeleton argument. I will try to do my best to reflect both the argument as originally made in the skeleton argument and the argument as it developed.

(i) The Claimants' Original Interpretation

- The Claimants start from the definition given of SVR in Condition 1.2:

"… such rate as we from time to time decide to set as the base from which to calculate Interest on our variable rate mortgage loans."

- They argue that this leads inexorably to the conclusion that TSB is required, once it seeks to vary the rate or adopt any rate other than Northern Rock's SVR, to charge its own SVR under the mortgage contracts, because by Condition 1.1, from the moment of the transfer, TSB becomes "We" for the purposes of the General Conditions. Thus, they read the definition as it applies following the transfer as:

"… such rate as [TSB] from time to time decide[s] to set as the base from which to calculate Interest on [TSB's] mortgage loans…"

- I will call this reading of Condition 1.2 the "Claimants' Original Interpretation".

(ii) The Claimants' Developed Interpretation

- This point was developed slightly differently in oral argument, in that Mr Lord acknowledged that TSB could continue to charge interest at the previous rate fixed by Northern Rock that was in force at the time of transfer, even though this was not a rate decided upon by TSB and was not used to calculate interest on other mortgage loans made by TSB and so did not fall within the reading of the definition argued for as set out in the paragraph immediately above. Mr Lord's argument was that it was only at the point that TSB purported to set a different interest rate that the reading of the definition set out in the previous paragraph will apply.

- For reasons discussed at [126] to [128] below, I think this was a necessary development of the argument. I think, therefore, that the definition they were actually contending for is better transcribed as follows:

"… such rate as [Northern Rock or TSB] from time to time decides to set as the base from which to calculate Interest on [the lender's] mortgage loans…"

In other words, the focus of what is meant by "we" in the definition of SVR according to the Claimants' argument has to be on who is the lender at the point of setting the rate. When Northern Rock sets the rate, it did so by reference to the considerations out in Condition 7 as applied to its whole loan book. That rate remained the SVR until there was an amendment to rates. At that point, if TSB was making the decision, it must do so by reference to the considerations set out in Condition 7 as applied to its whole loan book. I will refer to the Claimants' argument as so developed as the "Claimants' Developed Interpretation".

- The Claimants argue further that the remainder of the definition takes one to the same place:

"If we transfer or dispose of the Offer, the person to whom we make the transfer [ie. TSB] may change the rate to its own base rate which it applies to its variable rate mortgage loans."

- They argue that this further part of the definition provides no suggestion that TSB might charge a different rate other than its own standard variable rate. They conclude therefore that TSB was acting wrongfully in applying what it described as the "Whistletree SVR ", as this was not the rate that it was applying to its own mortgage loans.

- The Claimants argue also that there is an important commercial purpose as to why the former Northern Rock customers should not be charged at a different rate to TSB's other customers. This was that there was an obligation of equal treatment between a bank's borrowers. This obligation prevents different borrowers on a standard variable rate mortgage from being treated differently. Mr Lord used the term "herd protection" meaning that by being required to treat all borrowers on the same "standard" variable rate, borrowers would know that there would be a commercial imperative to set that rate fairly so as to avoid borrowers who could leave from leaving and so as not to discourage potential new borrowers.

- The Claimants argue that this construction is also supported by testing it against the other provisions of the mortgage contracts.

- As noted above, it was their argument that a transferee may only make changes to the SVR under Condition 7.2 if it has first changed the rate applicable under that condition. TSB did, as is common ground, change the SVR a number of times in purported reliance on Condition 7.2. It could only do so, in the Claimants' contention, if it had already changed the SVR to one of its own existing SVRs.

- It was important to this argument that Condition 7.2 permitted the relevant lender to increase the SVR by reference to various factors, a number of which were referable to its own circumstances: for example, to maintain a prudent level of profitability or by reference to its administrative costs. Therefore, the argument runs, if TSB were to exercise any power to increase the SVR, it would need to do so having regard to its own costs of funds, profitability and administrative costs. If TSB had been entitled to take as its starting point the difference between the BoE Base Rate and the SVR as determined by Northern Rock (as it did), then that, in the Claimants' submission, made a nonsense of Condition 7.2. If the margin between the SVR and the BoE Base Rate had originally been set by Northern Rock to reflect its own cost of funds etc. how, then, could TSB say that it needed to increase the SVR to meet its own cost of funds when the existing rate reflected someone else's cost of funds?

- In addition, whilst Condition 7.2 set out a detailed set of circumstances in which the lender under the mortgage contracts could increase the SVR, there was no contractual requirement under Condition 7.1 requiring the lender to reduce it should circumstances change so that the loans have become more profitable for the lender. The protection that a borrower had against a bank arbitrarily failing to reduce its rate was market competition, but that would be of limited assistance in the circumstances of the Whistletree Borrowers (who, according to the Claimants' argument, were unable to take advantage of market competition as they or many of them were mortgage prisoners), unless they had to be treated equally with TSB's other customers. That is why it should be regarded as critical that there is such an obligation of equal treatment.

- There was a further textual point backing this argument based on the use of the word "standard" in the defined term SVR. Mr Lord referred me to the FCA's definition of a standard variable rate, I think, with a view to persuading me that the choice of this defined term was intended to echo the FCA's definition. The Claimants' argument is that the use of the word "standard" in the defined term is significant. It connotes that it will be the relevant lender's "standard" rate, rather than a bespoke one for a particular group of borrowers. A borrower could reasonably take comfort from the fact that there would be an element of protection from market forces in their interest rate being kept at the same level as other borrowers of the same bank.

(iii) Discussion of the Claimants' arguments

- The points based on Condition 7 and the requirement for a "standard" rate across different groups of borrowers were heavily relied upon by the Claimants as arguments why their reading of the Conditions must be correct, but I find them less than persuasive. This is for a number of reasons.

- First, the "herd immunity argument" is one of those points that makes more sense viewing the matters with the benefit of hindsight than it does in looking at the position of the mortgage arrangements when they are entered into. When these contracts were entered into the "herd" that might have been in the mind of the parties was that of Northern Rock customers only. Whilst transfers to another lender were clearly contemplated, there could be no knowledge of what the nature and circumstances of any new lender would be. The lender might be another bank or building society that would have other customers, but equally or even perhaps more likely, it might be special purpose vehicle such as a securitisation vehicle or a vehicle used to administer closed books which would not have other customers so there would be no additional herd immunity arising from the transfer.

- Even if the transferee was a bank or mortgage lender with an existing book, there would only really be additional herd immunity protection if either the lender was still offering mortgages using that rate, so that an uncompetitive rate would discourage new customers, or if the existing customers of the new lender had a smaller proportion of mortgage prisoners than was the case for the former Northern Rock customers - if the existing customers of the new lender included a greater proportion of mortgage prisoners then the incentive to keep the variable rates above market rates might be even more tempting than it was before the transfer.

- Given the uncertainties of the future, it would be very difficult to say that the Northern Rock customers were relying on any future replacement lender offering additional herd immunity, to such an extent that this should be viewed as a fundamental principle to be taken into account in interpreting the General Conditions.

- Secondly, the argument that herd protection was needed to protect against unfair decisions made in relation to increases or reductions of the interest rate is weakened by what is now the common position of the parties as regards the implied term issue.

- Thirdly, the argument that moving on to TSB's variable rate was necessary to make sense of Condition 7 does not follow as a matter of logic. The effect of TSB not having the same starting point as Northern Rock so as to justify rate changes by reference to a change in conditions applicable to the lender does not make Condition 7 unworkable – it merely constrains the aspects of Condition 7 that TSB might reasonably rely upon.

- There were no conditions to be satisfied before a reduction in the SVR could be made. As regards increases there were conditions. Some of them did look at the position of the lender as regards such matters as profitability and administrative expenses, but others did not.

- If TSB had purported to justify increases in the base rate by reference to conditions that related to increases in its administrative costs or reductions in its profitability or any other factor applying to it individually, then I can see that it might have had problems in establishing the justification for the rise since there would be no starting point for judging whether there had been an increase in costs or a reduction in profits. But that would be TSB's problem and one that it would need to take into account when taking on the mortgage portfolio. However, in practice TSB only ever increased the rate to reflect increases in the Base Rate and under the express language of condition 7.2 it was entitled to do so irrespective of its profitability or administrative costs.

- Of course, it may be that TSB's approach was in breach of the implied condition. The Claimants argue by reference to TSB's accounts that TSB was making an unwarranted level of profits out of the Whistletree mortgages and it may be that on the basis of this they can establish a breach of the implied term discussed above. However, this is a discussion for another day. It is not a point to be decided at this stage of the proceedings.

- As regards the use of the word "standard" in the definition of "SVR", I agree that it is true that the courts have found that it is permissible to take account of the label that the parties choose to put upon their defined terms.

- In Chartbrook Ltd v Persimmon Homes Ltd [2009] AC 1101, Lord Hoffmann said:

"But the contract does not use algebraic symbols. It uses labels. The words used as labels are seldom arbitrary. They are usually chosen as a distillation of the meaning or purpose of a concept intended to be more precisely stated in the definition. In such cases the language of the defined expression may help to elucidate ambiguities in the definition or other parts of the agreement."

- Nevertheless, I am loath to put too much reliance on the use of the word "standard" within the defined term in this case. This is for two reasons.

- First, it is by no means clear what precisely the word "standard" connotes in its context. Clearly the SVR was "standard" in the sense that it was the one being applied to all Northern Rock customers who are on a variable rate. I think it is reading too much into the choice of this word in a defined term to say it must mean that if the former Northern Rock borrowers become part of a larger group of borrowers it necessarily connotes that there must be one standard rate applying to all borrowers. This is particularly the case since it is clear elsewhere in the General Conditions that it was envisaged that a transferee lender might have more than one variable rate that it uses for its customers.

- Secondly, whilst I think this is a point to take into account, in my view the wording of the definitions in the contract and the iterative approach to understanding the contract as a whole will take precedence over this particular point.

- For completeness I should add that, in addition to arguments about the definition in Condition 1.2, Mr Lord referred to terms about interest in one of the Offer Letters where it said:

"On expiry of the Special Rate Period the rate will be set at a rate guaranteed to be below our prevailing Standard Variable Rate set by us from time to time for existing Northern Rock borrowers".

- This wording related to one of the Together Offers. Mr Lord took me to definitional provisions in the Loan Conditions (i.e. those relating to the Together Loan) which defined "Lender", "us", "we", "our", and "Northern Rock"' to mean "Northern Rock plc and its successors and assigns". He took from this the conclusion that the wording referred to in the previous paragraph, following transfer to TSB, must mean the standard variable rate set by TSB from time to time for existing TSB borrowers: i.e. following the transfer to TSB it would read:

"On expiry of the Special Rate Period the rate will be set at a rate guaranteed to be below TSB's prevailing Standard Variable Rate set by TSB from time to time for existing TSB borrowers".

- This point arose late in the argument and seemed to me to involve something of a recantation from the Claimants' Developed Interpretation. I am not sure that Mr Lord fully resolved the tension between the Claimants' Developed Interpretation and the implications of his arguments here, which seemed to take him back to the Claimants' Original Interpretation, with the problems I highlight at [126] to [128] below, in interpreting Condition 19.

- Equally importantly, consideration of this wording in the Offer Letter (or some of them) adds little or nothing to the analysis around the definition of SVR in Condition 1.2.

- If the Claimants' interpretation of the definition of SVR is accepted, then this wording is compatible with that interpretation.

- However, this wording is equally compatible with the interpretation of the definition of SVR that is contended for by the Defendant (i.e. the Standard Variable Rate used by Northern Rock and following transfer by TSB to calculate Interest for the purposes of the General Conditions), so that the reference to "existing customers" must be taken as "existing customers" who are subject to the General Conditions – ie its customers who are former Northern Rock customers.

- If we accept the Defendant's interpretation and take full cognizance of the fact that the definitional provision referred to in the Loan Conditions talks of "Northern Rock plc and its successors and assigns" which in this context should in my view be read loosely to mean "and/or" (as the parties each accepted in relation to the use of "and" in the definition of SVR), then the Defendant's reading of the wording seems to fit at least as well as that contended for by the Claimants. The Defendant's reading would be:

"On expiry of the Special Rate Period the rate will be set at a rate guaranteed to be below Northern Rock's or (where there is a successor, its successor's) prevailing Standard Variable Rate set by Northern Rock and/or its successor from time to time for existing borrowers [who pay Interest under the General Conditions at the Interest Rate].

- The argument based on the wording in the Loan Conditions, therefore, does not assist in choosing between the Claimants' interpretation and the Defendant's interpretation. It is also of arguable relevance given that the interpretation of the General Conditions needs to work for all the mortgage loans advanced by Northern Rock, and this wording would have been available only to some of them who held Together Mortgages. For all these reasons, I will attach no weight to the argument based on this wording.

(iv) The Claimants' attack on TSB's argument

- I believe the points above capture the main thrust of the Claimants' argument in favour of their interpretation. The remainder of their argument was attacking what they perceived to be the argument being made by TSB.

- In particular, the Claimants understood that TSB was claiming that it had a right to create a new standard variable rate purely for the Whistletree customers. The Claimants deployed arguments against this contention including that:

i) The natural and ordinary meaning of the definition of SVR is that it is limited to a pre-existing variable rate which the transferee already had in place. A specially-created new variable rate is not "one of [TSB]'s own standard variable rates".

ii) If TSB was entitled to create a new rate for the Whistletree borrowers, then logically it was not limited to charging a single, new rate to all Whistletree customers. It could have evaluated each new Whistletree Borrower separately, and devised a new interest rate for each of them, and charged them that rate, leading to hundreds of new "SVRs". That would be absurd, and would give no effect to the meaning of the provision.

- However, these arguments were attacking a different argument to the argument that TSB advanced in oral submissions. TSB's argument was that TSB was operating the original SVR, not a new rate. The fact that it rebadged this as the "Whistletree SVR" was just a marketing convenience. The result of the definition of "we" was that following the transfer TSB was in the position originally occupied by Northern Rock so that it had become entitled to set the Standard Variable rate and in fact had done so. The arguments made that I have summarised in the previous paragraph therefore are not pertinent to the argument that TSB is now pursuing.

- The Claimants made a number of other points by way of an attack on the position put forward by TSB. I will deal with these as I explain TSB's position.

8. TSB'S ARGUMENT ON INTERPRETATION

- I now turn to dealing with TSB's argument in more detail.

- As I have already described at [35] to [40], it is simply this. As a result of the definition of "we", following its acquisition of these mortgage loans TSB stood in the place of Northern Rock for all purposes under the contract and became entitled to fix the SVR. References to "we" in conditions 6 and 7 became references to TSB.

- When TSB was amending what it referred to as the "Whistletree SVR" it was merely continuing to operate the same SVR which had originally been operated by Northern Rock. The fact that it called this by a different name, to distinguish it from other rates that it operated for other customers, was immaterial.

- TSB disposes of the Claimants' argument that the phrase within the definition of SVR referring to "such rate as we from time to time decide to set as the base from which to calculate Interest on our variable rate mortgage loans" must mean that one looks at TSB's other mortgage loans, by pointing out that the reference to "Interest" makes it clear that this reference is alluding only to loans that are made under the General Conditions, and not to loans made under other terms and conditions.

- As a result, TSB argues that it was entitled to continue to keep the Whistletree borrowers on the same rate and to operate the entitlements under Condition 7 to vary that up and down, and that is what it did.

- I find this interpretation compelling, and certainly a far more natural reading of the provisions than that contended for by the Claimants.

9. WHICH INTERPRETATION WORKS?

- The matter comes into sharp relief when one considers the provisions of Condition 19.1 (reproduced at [63] above). Condition 19.1 records that if the lender chooses to transfer its rights under the Offer to another mortgage lender it can do so without the consent of the borrower and that there are two powers in particular that it can confer on the transferee lender:

i) first the right to set the Interest Rate; and

ii) secondly, where the Interest Rate is set by reference to the SVR an option (connoted by the word "may") instead to set the interest charged under the Offer by reference to that person's own (or one of its own) standard variable rates.

- TSB's interpretation is, in my view, compelling. It presents no real contextual difficulties; it allows the General Conditions to be interpreted in an entirely consistent manner; and it provides the result that is also consistent with the way that one would expect transfers of mortgages to work. Neither is it, in my view, a term that would be expected, at the time it was entered into, to operate unfairly as regards the mortgage customers.

- To take first the question of lack of contextual difficulties. The Claimants' interpretation ignores the implications of the use of the capitalised term "Interest" within the definition of SVR. I agree with Ms Tolaney that the use of this capitalised term clearly ties the definition of SVR into referring to the rates that are set as the base from which to calculate the interest payable under these General Conditions. It cannot refer to rates that are charged on loans that are not subject to the General Conditions.

- The Claimants have no real argument against this point. The most that can be said is that the reference to condition 6 in the definition of "Interest" (in the 2004 General Conditions) or in the definition of "Interest Rate" (in the 2001 General Conditions) is a reference to a condition relating to the payment of interest rather than anything to do with the calculation of the rate of interest. That argument is not material. The point is that the reference to Condition 6 is still effective to have the effect that references to "Interest" must mean interest payable under the General Conditions, and therefore the reference to "Interest on our variable rate mortgage loans" must refer only to interest on loans that are subject to such General Conditions.

- The Defendant's interpretation allows a consistent view of how to apply the definition of "we". It operates as one would expect: in all contexts within the General Conditions where there has been a transfer, references to "we" and the like terms are to be replaced by references to the transferee lender, with the only exception being provisions such as Condition 19.1 where the clause is clearly dealing with the position of both the transferor lender and the transferee lender where it is clear from the context that "we" in places continues to refer to the transferor lender.

- The Claimants' interpretation gets into particular difficulties when one tries to apply it to Condition 19.

- The Claimants' Original Interpretation of the SVR definition as set out in their skeleton argument, and reproduced at [77], had the effect of causing the SVR immediately following the transfer to become the rate of interest calculated by TSB on its mortgage loans at large. This rapidly becomes an unsustainable argument when one tries to apply Condition 19, since if the SVR already means the interest rate charged by the transferee lender to its other customers, then there is no meaning to the provision in Condition 19.1 that the transferee lender could transfer from that rate to its own standard variable rate – they would be the same thing.

- This point, no doubt, is why in oral argument Mr Lord moved to the Claimants' Developed Interpretation explained at [80] above: this at least allows some meaning to Condition 19 in that it could involve a move from the original rate set by Northern Rock to another rate. However, it still requires a more convoluted application of the definition of "we", so that "we" in the definition of SVR continues to mean Northern Rock until there is a new rate decision, and only at that point does it refer to the new lender.

- Further, it still does not resolve the interpretation of Condition 19.1. The natural reading of Condition 19.1 is that the transferee lender can be given two powers (1) the right to set the interest rate and (2) (separately) the right to set the interest charged under the Offer by reference to that person's own standard variable rates. The Claimants' interpretation allows only the second power. If the Claimants' interpretation was the intended interpretation, the clause would have been drafted differently to make this clear.

- A further textual difficulty with the Claimants' proposed interpretation is that the definition of SVR that it contends for only works if the transferee lender already operates another mortgage book. The lender would not have another rate without this. This, therefore, appears not to work in the case of a transfer to a special purpose vehicle such as a securitisation vehicle or a vehicle for holding a closed book of mortgages.

- Mr Lord attempted to explain this away by saying that such a special purpose vehicle would have its own rate, since it would adopt a rate for the purposes of these mortgages, but this is unconvincing as this is precisely the behaviour that he says that TSB is not allowed to undertake.

- The Claimants' interpretation is also difficult to apply if the transferee company has more than one variable rate that it uses for its other business. Such a state of affairs was clearly envisaged within clause 19.1 and yet the point is not dealt with in the definition of SVR and would need to be if the Claimants' interpretation was correct.

- Moving onto my second point, the result is consistent with the way that one would expect transfers of mortgages to work. The expectation of someone who takes out a mortgage that includes terms allowing for the rights under the mortgage loan to be transferred to another lender is that they would expect the same treatment from that other lender, not a better or worse treatment.

- In the particular circumstances of the transfer to TSB, the former Northern Rock customers would be better off if they were transferred to the TSB SVR or the TSB HVR. But that could not be guaranteed had there been a different transferee. If the Northern Rock mortgages had been transferred to a mortgage lender that operated a higher standard variable rate for its existing customers, then the Claimants' interpretation would work against their interest.

- Mr Lord had an argument to counter this on the basis that the terms of the Offer Letters or at least some of them dealing with the Together Loans referred to increases in the SVR only under Condition 7, and therefore if the result of a transfer to another mortgage rate was to increase the amount payable this could not take place.

- I found this point unconvincing for two reasons.

i) First, the wording I was taken to was in the following form:

"Section A of this Offer of Loan will indicate whether Interest is charged on an annual or daily basis. Please refer to Clause [sic] 7 of the Mortgage Offer General Conditions 2001, which gives details of when the Standard Variable Mortgage Base Rate may change"

This wording seemed to be designed merely to draw the attention of customers to Condition 7 of the General Conditions. The Offer Letter expressly applied the General Conditions to the Offer and this wording did not seem to be sufficiently clear to oust the clear terms of Condition 19.

ii) Secondly, I did not see how unsecured loans offered to some only of the mortgage customers could change the interpretation of General Conditions that needed to be used for all customers.

- In summary on this point, I find the interpretation put forward by the Claimants to be too far removed from the clear terms of the General Conditions to be a credible interpretation of them, whilst I see no problems with the interpretation put forward by TSB.

- There were some arguments raised by the Claimants as regards TSB's interpretation that I should deal with.

- In the Claimants' skeleton argument, the point was made that TSB relies heavily on the fact that Condition 1.2 states that TSB "may" (and not "must") change the Interest Rate to its own SVR.

- This is true, although I think that TSB would place emphasis on the use of the word "may" within Condition 19.1, rather than in Condition 1.2. I agree with TSB that Condition 19.1 is the better place to look, as Condition 1.2 is there only to explain the use of the term "SVR": Condition 19.1 is the substantive provision saying how a handover will work. Condition 1.2 should be regarded as merely a summary for indicative purposes of the provisions properly set out in Condition 19.1.

- However, the Claimants' objection made on the basis of this point depends on its contention that TSB does not (and could not) contend that it was applying the Northern Rock SVR. In fact, that is precisely what TSB is claiming - that following the transfer they were in the shoes originally filled by Northern Rock and were continuing to administer the same SVR as Northern Rock had administered for the purposes of calculating Interest as defined in the General Conditions. This point disposes of this objection of the Claimants and also of a number of other arguments they made that proceeded on the basis that the Whistletree SVR was a new rate and was not the continuation of the Northern Rock SVR.

10. CONCLUSION AS REGARDS THE EXPRESS TERMS ISSUE

- It will be clear from the analysis above that I answer the Express Terms Issue as follows.

- The Defendant has not breached the express terms of the Claimants' mortgage contracts by charging the Claimants interest rates based on the Whistletree SVR and not on the TSB SVR. The Whistletree SVR should be regarded as the continuation of the original SVR originally operated by Northern Rock, and not as a new rate.

11. THE CCA ISSUE

- The CCA issue concerns the application of s.140A(5) CCA 1974 to the circumstances of the "Together" Offers.

- As I have mentioned, the Together Offers comprised an unsecured loan (the "Together Loan") that was offered alongside a regulated mortgage (the "Together Mortgage"). The Together Loan was linked to the Together Mortgage in that the interest rate under the unsecured loan was set to match that made applicable from time to time to the Together Mortgage, but would increase to a substantially higher rate if the Together Mortgage was repaid. Through these arrangements borrowers could borrow on mortgage up to 95% of the value of their residential property, and at the same time obtain an unsecured loan up to a further 30% of the value of the property (capped at £30,000).

- The Claimants that have, or have had, Together Loans (the "Together Claimants"), which I am told number about a half of the total number of Claimants, bring a claim on the basis that the relationship between them and TSB arising out of the Together Loans, either alone or taken with the Together Mortgages, was unfair. The unfairness they allege relates to various matters, including the manner in which interest was charged as addressed above, the fact that Together Claimants were encouraged to borrow well in excess of 100% of the value of their property, and the fact that the rate increase that would occur if the mortgage was redeemed was very high, out of proportion to any increase in risk, and a disincentive to remortgaging.

- In bringing their claims on this basis, the Together Claimants are looking to bring themselves within provisions in s.140A to s.140C CCA 1974 (the "CCA unfair relationship provisions"). The drafting within the CCA unfair relationship provisions that is most relevant to this issue is as follows:

"140A Unfair relationships between creditors and debtors

(1) The court may make an order under section 140B in connection with a credit agreement if it determines that the relationship between the creditor and the debtor arising out of the agreement (or the agreement taken with any related agreement) is unfair to the debtor because of one or more of the following -

(a) any of the terms of the agreement or of any related agreement;

(b) the way in which the creditor has exercised or enforced any of his rights under the agreement or any related agreement;

(c) any other thing done (or not done) by, or on behalf of, the creditor (either before or after the making of the agreement or any related agreement).

(2) In deciding whether to make a determination under this section the court shall have regard to all matters it thinks relevant (including matters relating to the creditor and matters relating to the debtor)."

…

(5) An order under section 140B shall not be made in connection with a credit agreement which is an exempt agreement for the purposes of Chapter 14A of Part 2 of the Regulated Activities Order by virtue of article 60C(2) of that Order (regulated mortgage contracts and regulated home purchase plans)."

….

140B Powers of court in relation to unfair relationships

(1) An order under this section in connection with a credit agreement may do one or more of the following -

(a) require the creditor … to repay (in whole or in part) any sum paid by the debtor … by virtue of the agreement or any related agreement (whether paid to the creditor, the associate or the former associate or to any other person);

(b) require the creditor … to do or not to do (or to cease doing) anything specified in the order in connection with the agreement or any related agreement;

(c) reduce or discharge any sum payable by the debtor … by virtue of the agreement or any related agreement;

…

(e) otherwise set aside (in whole or in part) any duty imposed on the debtor … by virtue of the agreement or any related agreement;

(f) alter the terms of the agreement or of any related agreement; …"

- S.140C includes various interpretive provisions that need not be examined for the purposes of this judgment.

- In summary, if the court determines that there is an unfair relationship arising out of a credit agreement (or out of a credit agreement taken together with a related agreement), it may make an order under s.140B in connection with that credit agreement. The court has a broad discretion under s.140B as to the remedies it may impose, and can require, among other things, the repayment of sums paid under the credit agreement or a related agreement.

- However, as a result of s.140A(5), the court cannot make an order, "in connection with" an agreement that is exempt by virtue of article 60C(2) of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001.

- An exempt agreement would include any regulated mortgage contract entered on or after 31 October 2004. The parties agree, therefore, that s.140A(5) has no application to any Together Mortgage that was entered into before this date - no problem arises under s.140(A)(5) in treating such mortgages either as credit agreements in their own right or as a related agreement in applying the CCA unfair relationship provisions.

- The parties agree that:

i) The Together Loans themselves are credit agreements that may form the basis of a claim under s.140(A); and that

ii) s.140A(5) has the effect that such a Together Mortgage entered after 31 October 2004 cannot be treated as a credit agreement in its own right to form the basis of a claim under s.140(A)(5).

- However, the CCA issue arises because the parties do not agree as to the effect of s.140(5) where a Together Mortgage that was a regulated mortgage contract entered on or after 31 October 2004 is claimed to be a related agreement to a Together Loan.

- The Together Claimants argue that they do not seek an order under s.140B "in connection with" the Together Mortgages; they seek an order "in connection with" the Together Loans. They submit that when deciding what order to make in connection with the Together Loans:

i) the court is not precluded from having regard to the terms or implementation of a Together Mortgage in assessing or from making an order under s.140B redressing unfairness in the relationship arising out of the Together Loans "taken with" the Together Mortgages; and

ii) by the express terms of the opening words of s.140B, such an order, even if it orders repayment of monies paid under the Together Mortgage as a related agreement, is an order "in connection with" the Together Loan.

- The Claimants' case is that the Together Mortgage is a "linked transaction" in relation to the Together Loan, such that it is legitimate to have regard to the terms of the Together Mortgage when considering the fairness of the relationship arising between the Together Claimants (in their capacities as borrowers under the Together Loans) and TSB – even if the Together Mortgage is a regulated mortgage contract entered after 31 October 2004.

- Conversely, TSB argues that, even if a Together Mortgage (that was a regulated mortgage contract entered into on or after 31 October 2004) can be regarded as a related agreement to the Together Loan, if an order is made by reference to such a Together Mortgage, for example because it calculates a payment of damages by reference to interest payable under the Together Mortgage, and certainly if it requires repayment of interest payable under the Together Mortgage, then the order should be regarded as being "in connection with" the Together Mortgage and therefore is precluded under s.140A(5).

- I should mention that TSB does not accept in its pleadings that the Together Mortgages are linked transactions, but this is an argument for another day. The CCA issue has been formulated in a way that is neutral on the point, as it asks the court to look at the question "irrespective of whether that regulated mortgage contract is the "credit agreement" or a "related agreement"". For simplicity, in addressing the matter, I will assume that the Claimants are correct that the Together Mortgage is a linked transaction and therefore a "related agreement" in relation to the Together Loan, but this should be taken as an assumption relied on for the sake of argument rather than as any determination by the court. For simplicity also, references to Together Mortgages or to regulated mortgages in the discussion below should be assumed to refer to those which are regulated mortgage contracts entered into on or after 31 October 2004.

12. THE CCA ISSUE IN MORE DETAIL

- The Together Claimants' case on the effect of s.140A(5) is that, although it prohibits the court from making an order "in connection with" a regulated mortgage contract, it does not prohibit the court when making an order in connection with a credit agreement from taking into account the terms or implementation of a linked transaction (whether a regulated mortgage contract or not). Nor does it prevent the Court from making an order in connection with a credit agreement that alters or relates to the terms of (or payments under) a related agreement That is expressly permitted by s.140B, and that, in their argument, must be so whether the related agreement is a regulated mortgage contract or not.

- TSB's argument may be summarised as saying that, just because an order is made "in connection with" a Together Loan, that does not preclude it from also being "in connection with" a Together Mortgage; and an order that is made "in connection with" a Together Mortgage is prohibited by s.140A(5).

- Looking at this in more detail, the Together Claimants argue that there are three aspects to the issue, or, as I would put it, three possible contentions as to the extent of the effect of s.140A(5).

(i) The Exclusion of Consideration Contention