HHJ Pearce :

- By the Claim Form in this action, the Claimant seeks delivery up of a bus, registered number 7 OUR ("the Vehicle") which it leased to the First Defendant pursuant to a lease agreement dated 26 October 2018 ("the Lease Agreement") together with sums allegedly due from the First Defendant under the Lease Agreement and from the Second Defendant (as guarantor of the indebtedness of the First Defendant). The Particulars of Claim plead the Lease Agreement entered into between the Claimant and the First Defendant for a primary term of 60 months commencing on 26 October 2018. It is asserted that the First Defendant has failed to make payment of rentals, in consequence of which the Claimant terminated the agreement on 24 November 2020 and demanded the return of the vehicle but the First Defendant has failed to return it, hence the Claimant seeking an order for delivery up. Further, the Particulars of Claim plead a guarantee dated 26 October 2018 between the Claimant and the Second Defendant ("the Guarantee"). The Claimant contends that the First Defendant is liable to it for sums due upon termination of the lease agreement and, as indicated, that the Second Defendant is liable as guarantor of that indebtedness.

- A witness statement from the Claimant's Collections Manager, Ms Hayley Baldwin, dated 4 March 2021, annexes the Lease Agreement and the Guarantee, as well as a sale agreement relating to the Vehicle. At paragraph 5 of her statement, she explains that the Claimant purchased the vehicle from the First Defendant, in part paying off existing liability to a finance company, in part paying a sum of money to the First Defendant itself. She asserts at paragraph 10 of the statement that the Claimant terminated the agreement and at paragraph 12 of the statement that the First Defendant has not cooperated in allowing the Claimant to recover the vehicle. She asserts that the sum due from the First Defendant under the lease agreement and from the Second Defendant, as guarantor, is £149,836.84 plus interest at the date of issue the proceedings of £1,070.68 and interest to the date of hearing (15 March 2021) of £1,132.45.

- In their Defence, the Defendants contend that the claim should be transferred to the Chancery Division and that, unless certain disclosure is given, the claim should be struck out. A witness statement from the Second Defendant, dated 2 March 2021, sets out the Defendants' case in a little more detail, asserting:

i) The case involves "complex trusts and securitisation";

ii) The Queen's Bench Division has no jurisdiction to hear the case;

iii) The case should be transferred to the Chancery Division;

iv) The Claimant is in fact acting as the agent of a "security trustee", Citicorp Trustee Company Limited, but has no right to bring the claim. In support of this, the witness statement refers to an exhibit, although that exhibit was not in fact filed with the original witness statement or included in the bundle for the hearing on 15 March 2021. It was eventually provided to me about 40 minutes into a hearing which had been listed with an estimate of 1 hour. Having read it and heard from the Second Defendant, I reserved judgment on the application to ensure that I properly understood what was being argued.

The Defence does not however dispute the facts as set out at paragraphs 1 and 2 above, nor was it suggested during the hearing on 15 March 2021 that any of those facts are disputed.

- On 2 March 2021, the Second Defendant issued an application for transfer of the proceedings to the Chancery Division. At the hearing on 15 March 2021, I dealt with that application first. In my judgment, the claim brought by the Claimant clearly relates to "a commercial or business matter in a broad sense," the primary criterion for issuing in the Circuit Commercial Court (see CPR 59.1(2)(a)). Were it to be a high-value claim (that is to say an excessive £50 million), it might well have been set better suited to the Financial List (itself a list which crosses over between the Chancery Division and the Queen's Bench Division). However, the value comes nowhere near that for which the Financial List was created and in there is no other list within the Business and Property Courts more suited to dealing with the claim. Insofar as the defence related issues of trust law, the Defendants are perfectly entitled to raise and have those issues adjudicated upon within the Circuit Commercial Court, with exactly the same law being applicable as if the case had been issued in or transferred to the Chancery Division. Insofar as it might be suggested that the case requires specialist legal knowledge in which judges of the Chancery Division are more versed, the Specialist Circuit Judges of the Business and Property Courts in Manchester (including myself) are "cross ticketed" so that all sit both in the Chancery Division and the Circuit Commercial Court. Had it been necessary to transfer the case, I would simply have transferred it to the Chancery Division and continued with the hearing. For the reasons set out above, such transfer was not necessary.

- I turn to consider the procedural basis of the application. This was a case which was listed with a fixed date at the invitation of the Claimant. CPR 7.9 sets out circumstances in which a Practice Direction may provide for the court giving a fixed date for hearing when it issues the claim. Paragraph 7.9.1 of the White Book identifies actions for the return of goods as one of the common examples of the types of case to which a fixed hearing date may be given. In fact, the Practice Direction to CPR 7.9, namely PD 7B, relates only to claims under the Consumer Credit Act.

- It might therefore be suggested that a claim for the return of goods which is not brought under the Consumer Credit Act should not be the subject of the fixed date hearing procedure. However, actions for the recovery of goods, whether or not brought under the Consumer Credit Act, are suited to a procedure whereby the court holds an early hearing to determine what if any issues arise. Such cases are frequently not defended or are readily resolved by the parties attending court and discussing their differences.

- In this case, the parties attended the hearing, but the Defendants deny any liability, whether to deliver up the vehicle or to pay sums to the Claimant. The second question then is whether the court should give directions for the resolution of the issue between the parties or whether it should go further and determine some or all the issues on a summary basis.

- In my judgment, the Court must be cautious about proceeding on a summary basis at a fixed date hearing, at least where no application for summary judgment has been made. The Defendants do not have advanced warning in the same way as they do in a summary judgment application that an order may be made against them and furthermore may be deprived of the protection in CPR 24 and the associated Practice Direction, for example as to the requirement of the applicant to state that "on the evidence the respondent has no real prospect of

successfully defending the claim or issue."

- But where the material before the court at the hearing fails to disclose any defence to the claim (in whole or in part), there is no reason why the court should not proceed to making an appropriate order on a summary basis. This is how the court may have dealt with the claim had it been issued under CPR Part 8. In a Part 7 claim, such an approach would only be appropriate where all the requirements for summary judgment (as set out at paragraph 24.2.3 of the White Book) are made out, in particular that, without conducting a mini trial, the court is satisfied that the Defendant has no real prospect of successfully defending the claim or issue, bearing in mind not only the material before the court but the material which might reasonably be expected to be available at trial.

- The court should be particularly astute as to the position where, as here, the Defendant acts as a Litigant in Person and lacks legal knowledge. It should have in the forefront of its mind the possibility that defects in the case might be put right by more careful analysis and if necessary by amendment of statements of case. But the Defendants here have approached the hearing on the basis that they have to defend an application for an order for delivery up, filing evidence to support their position (albeit seeking an adjournment to obtain further disclosure). I am satisfied that no injustice will arise if the court considers on a summary basis whether the Defendants have a real prospect of successfully defending the application for an order for delivery up of the vehicle.

- I turn to consider the defence advanced to the claim for recovery of the vehicle. Neither the Defence itself nor the witness statement of Mr Coleman, provide any significant analysis that enables one to discern a defence to the claim. However, exhibit 1 to both the Defence and Witness Statement of Mr Coleman provides more detail. The exhibit is a so-called "Securitisation Analysis Report" ("the Report") dated 22 January 2021 and prepared for the Defendants in respect of the vehicle. The document appears to have been perfect prepared by Arthur A Bernardo, who describes himself as an "Expert Analysis on Auto Agreement Backed Securities Data" and a citizen of the United States and the State of California, and who has signed what is described as an "affidavit of facts."

- There are many points that may be made about the Report, including.

i) The form of the so-called affidavit does not coincide with any such document in English law, nor to the best of my knowledge does it comply with Californian law as to the swearing of an affidavit.

ii) The affidavit states the contents of the report to be factual and not be construed as amounting to legal advice, whereas in fact large parts of the report involve analysis of the legal consequence of the basic facts set out therein.

iii) The document does not identify the extent to which the conclusions reached are based upon the law of England, as opposed to the law of California (or indeed any other jurisdiction).

iv) The report contains language that at times tends to obfuscate rather than clarify what is being said.

- That all having been said, the fact that Mr Bernardo is willing to put his signature to this document must be taken as an indication that he would sign a witness statement to like effect that complied with English procedural law. Accordingly, I look to the merits of the defences that are being raised.

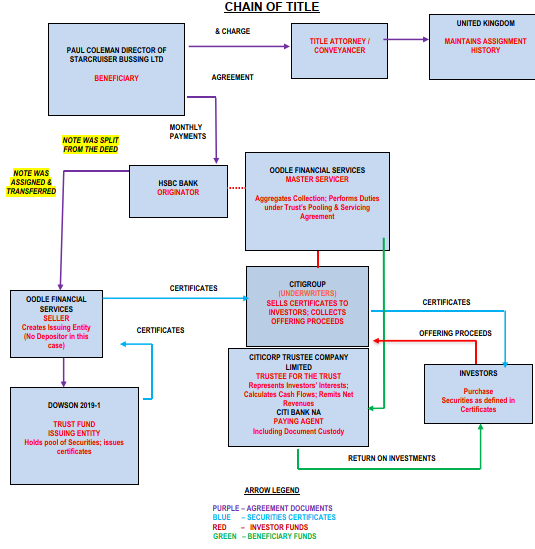

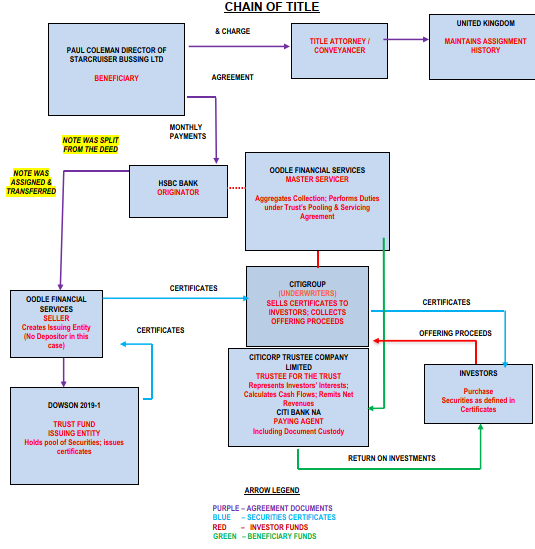

- The typical structure of so-called securitisation is the packaging of non-marketable assets into marketable securities by the holder of the assets selling them to a company which issues bonds or notes to investors under a trust deed, the assets being charged to the trustee to secure payment of the bonds or notes and the sale price being discharged from the proceeds of issue. Broadly speaking, this is what the Defendants allege has happened here.

- In order to understand the report, it is helpful to look at page 30 of Exhibit 1 to the Defence, a diagram setting out the so-called "chain of title":

- In his submissions, Mr Coleman raised the following as at least arguably giving a defence to the action for recovery of the vehicle:

i) He relies on paragraph 10 of the "affidavit", where Mr Bernardo says "Generally, if the Agreement and the Trust are not together with the same entity, there can be no legal enforcement of the Agreement. The agreement enforces the Trust and provide the capability for the Issuer to foreclose on the property. Thus, if the Agreement and the Trust are separated, foreclosure legally cannot occur. The Trust cannot be enforced by the Agreement if each contains a different Agreement/beneficiary; and, if the Agreement is not itself a legally enforceable instrument, there can be no valid foreclosure on the beneficiaries' property."

ii) He asserts that he and/or the First Defendant is the beneficiary of the trust which owns the vehicle and therefore the Claimant should not be entitled to recover the vehicle because to do so would be to recover it from the true owners.

iii) He asserts that the Claimant should be required to disclose documents which it is said will support a case that it is not entitled to recover the vehicle.

iv) He complains that the Claimant has shared his data with Citicorp Trustee Company Limited.

- Taking these points in turn:

i) I do not see that the Report shows that there has necessarily been a separation of the "Agreement" from the "Trust". Indeed, as one can see from the diagram above, Oodle Financial Services appears at two points in the flowchart, apparently the same body performing two different functions. The Defendant's evidence fails to persuade me that any such separation has taken place. Even if it had taken place, I do not follow Mr Bernardo's assertion that the Claimant is thereby no longer allowed to enforce the agreement. This is a bald assertion of a proposition without any authority to support it. Further, it is notable that Mr Bernardo's diagram does not even include the Claimant, the lessor of the vehicle. In my judgment, the Exhibit does not go any way to explaining how the Claimant has lost the right to sue for delivery up and/or for sums due under the lease, although I will separately below consider an alternative argument that might avail the Defendants.

ii) The assertion that one or both of the Defendants is a "beneficiary" appears to have been drawn by Mr Coleman from the diagram above, where he (or possibly the Second Defendant) is indeed so described. He has interpreted that to mean that he is the beneficiary of a trust of which Citicorp Trustee Company Limited is the trustee and of which the vehicle is an asset. I can see nothing in the diagram above to indicate that that is what is meant by the use of the word "beneficiary". More significantly I can see nothing in the facts of the case to explain how either Defendant would be the beneficiary of such a trust. In particular, the basis of the argument that the Defendants were owed fiduciary duties (which is said by Mr Coleman to be the root of the Defendants' beneficial interests) is entirely unexplained.

iii) Whilst I would be perfectly willing to order the disclosure of documents if the Defendants persuaded me that they had an arguable case, it is not the court's role simply to act as a vehicle for the disclosure of material which has no bearing on other matters being litigated. The court does not act as a general court of enquiry but rather acts in aid of cases that have a realistic prospect of success. I am not persuaded that there is any case with a realistic prospect of success to which the request for disclosure is relevant.

iv) I am entirely unclear whether the Second Defendant has a legitimate complaint about how his data has been handled. However, this court is not the first port of call for dealing with any such complaint. The Second Defendant has a variety of data protection rights, primarily through the Information Commissioner's Office. The making of a compliance order under Section 167 of the Data Protection Act 2018 is a discretionary remedy (see R (ex p Lord) v Secretary of State for the Home Department [2003] EWHC 2073, dealing with its legislative predecessor). The Second Defendant's data request which is at Exhibit 2 to the Defence is wide-ranging in nature. I am far from satisfied that I would be willing to make an order for an order under Section 167 in the terms of that request. In fact, there is no application under Section 167 before the court and I do not see the possibility that the Defendants might make such an application as an argument against ordering delivery up of the vehicle.

- I have also considered the possibility that, by reason of an assignment of its interest in the vehicle, the Claimant may no longer be entitled to recovery of the vehicle. It is certainly possible that assignment could lead to the loss of the right to recover, although whether it did so would require careful consideration of the detail of the assignment. However, it is not clear that there has been any assignment here and, even if there has, there is no suggestion that the Defendants have been given notice of assignment. In those circumstances, even if assignment were possible, it could only be equitable in nature. In the case of an equitable assignment, the assignor retains the right to sue on the agreement (see Three Rivers DC v Governor of the Bank of England [1996] QB 292). I conclude that the Defendants show no even arguable basis that any transaction by way of securitisation has deprived the Claimant of the right to bring this claim.

- Having considered the various arguments raised by the Defendants, as well as considered by the Court of its own motion, I conclude that the Defendants have shown no basis upon which they are entitled to resist the Claimant's application for an order for delivery up of the vehicle, nor do they show any reasonable line of enquiry that would justify the Court in delaying a decision on the issue. For these reasons, I am satisfied that an order for delivery up should be made. I shall invite submissions upon the terms of that order.

- As to the remainder of the claim, I indicated to counsel for the Claimant in argument that I was unpersuaded that it was procedurally right to give judgment for a money sum against either Defendant at a fixed date hearing unless the Defendant consents to the making of an order. There is a risk of unfairness to the Defendants, since the procedure followed is one established as suitable for the particular circumstances of a party seeking to recover goods, not, for example, of enforcing rights under a guarantee.

- The success of the application for an order for delivery up may mean that the Claimant does not wish to pursue the remainder of the case. On the other hand, given my judgment on the issue of recovery of the vehicle, the Defence as currently formulated does not appear to disclose any defence to the money claim and may be amenable to a summary judgment application.

- For these reasons, unless the Defendants consent to the making of an order, I do not propose to give judgment on the money claim. Again I propose to hear from the parties on the appropriate procedural steps to be taken. It may be that the Claimant should be given a short period of time to determine whether it wishes to pursue the remainder of the claim and, if so, to make a summary judgment application. I would also invite the parties to consider whether this is a case suitable for the Shorter and Flexible Trials Schemes, established by PD 57AB.