THE INDUSTRIAL TRIBUNALS

CASE REF: 2280/17

CLAIMANT: Darren McGavigan

RESPONDENT: Western Urgent Care

DECISION

The unanimous decision of the tribunal is that:

1.

The respondent, from April 2016 to the date of the tribunal hearing, made unlawful deductions from the wages paid to the claimant.

2.

The respondent, from April 2016, failed to pay to the claimant the relevant National Minimum Wage.

3.

The respondent, from January 2017, failed to provide the claimant with a sufficiently itemised written statement of pay. The respondent is ordered by the tribunal to supply the claimant with a statement of pay in the same format as that provided prior to January 2017.

4.

The respondent is ordered to pay to the claimant the sum of £2349.96.

Constitution of Tribunal:

Employment Judge: Employment Judge Browne

Members: Mrs L Hutchinson

Mr R Hanna

Appearances:

The claimant was represented by Mr G Kilpatrick, solicitor, of Thompsons NI, solicitors.

The respondent was represented by Mr D McGettigan, solicitor, of Peninsula Business Services (Ireland) Ltd.

ISSUES AND EVIDENCE

1.

The issues to be decided by the tribunal were, broadly speaking:

(i) Whether the claimant had a contractual right to receive an enhanced rate of pay for hours worked which were deemed to be unsocial or were worked on a Bank or Public Holiday;

(ii) Whether the respondent, in calculating the claimant's rate of pay, was correct to include any enhanced rate paid to the claimant to determine his average rate of pay and its compliance with the National Minimum Wage and National Living Wage;

(iii) Whether the respondent, in setting out the claimant's pay from January 2017 included sufficient detail to provide an itemised pay slip for the purposes of the relevant legislation.

2.

The case, broadly stated, is as follows:

3.

The claimant started working for the respondent in December 2007, and works as a driver, porter/security operative and as receptionist on an "as and when" basis. His claims before the tribunal relate only to the last two roles. His basic hourly rates of pay in early 2016 were £6.70 per hour for the porter role, and £6.82 per hour for the reception role.

4.

On his case, his work rotas ought to be viewed by the tribunal as amounting to an accurate statement of a term of his contract that he is entitled to an enhanced rate of pay for working unsocial hours and Bank and Public Holidays.

5.

The claimant's case is that such hours and enhanced rates of pay, calculated by multiplication of the prevailing hourly rate of pay, are an integral part of his contract of employment, which was communicated to him by Vincent Quigley, assistant manager. On that basis, he ought to be entitled to be paid to "time and a third" for night duty; Saturdays would be paid at "time and a half"; and Sundays and bank or public holidays would be paid at "double time".

6.

The respondent contends that, whilst the claimant is entitled to enhanced payments, they were and remain discretionary, in the form of an individual bonus, rather than being a contractual right. It was also claimed on behalf of the respondent that it takes a business decision year by year as to the setting of the rate payable.

7.

The claimant relies upon the previous enhancement rates as being paid at a rate multiple to that of the prevailing hourly rate of pay.

8.

In addition to its assertion that enhanced payments are in effect discretionary, the respondent also seeks to reserve the right to set the rate at a level previously paid as that of the National Minimum Wage.

9.

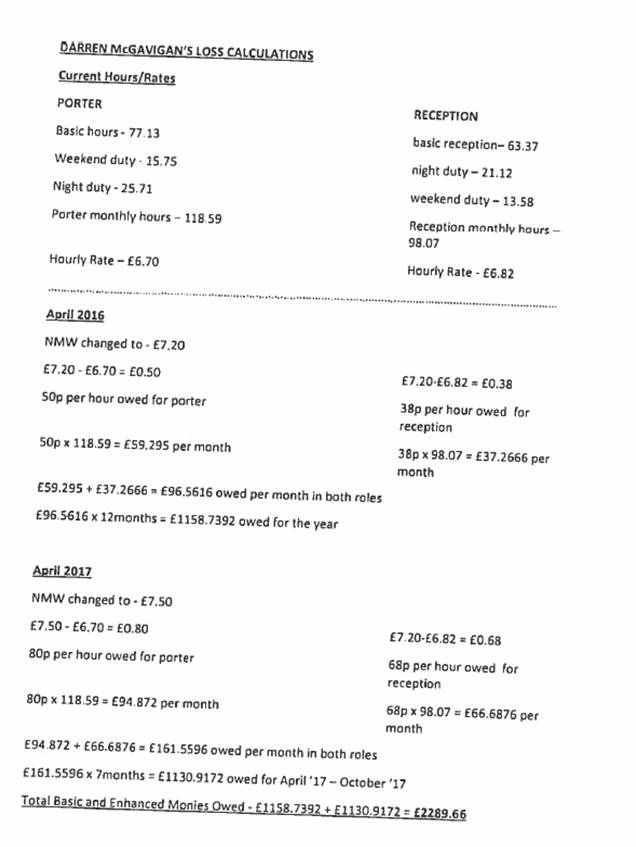

The respondent has now conceded that from April 2016 it was paying the claimant at an hourly rate of pay below that required by the relevant legislation, namely National Minimum Wage Act 1998, amended in 2016 and to introduce the National Living Wage rates of £7.20 per hour and £7.50 per hour respectively. On the claimant's calculation, assuming that his calculation method properly included the enhanced calculation based upon a percentage increase, related to the prevailing hourly rate of pay, he was still being paid at the lower national minimum wage rate.

10.

This arose due to the fact that, from April 2016, in order to calculate the claimant's hourly rate of pay, the respondent had added his basic hours payments to his unsocial hours premiums, multiplied it by the basic rate then paid, and divided the total by his actual hours worked.

11.

The claimant had queried this, as it resulted in what he regarded as an artificially high hourly rate, thereby excluding him from entitlement to the recently introduced National Living Wage. Whilst the National Living Wage hourly minimum rate was higher than the previous hourly minimum rate set as the National Minimum Wage, it was significantly lower than the hourly rate as calculated by the respondent.

12.

As a result of that calculation, whilst the clamant was not being paid less in total than before, he considered that the respondent's method of calculation deprived him of the increase of fifty pence and eighty pence per hour in his role as porter and receptionist respectively in order to raise his pay to the minimum level as required by the national living wage legislation.

13.

At the end of January 2017, the respondent unilaterally introduced a new format of pay slip, which replaced the previous format in that it no longer contained a breakdown of the claimant's hours worked and the rate of pay for those hours, which previously had included specification of unsocial hours worked and the relevant rates paid.

14.

On the respondent's case, this was done to simplify the procedure, to make it more comprehensible, not least because there were dozens of different pay structures in its operation. The claimant however perceived it as a ploy by the respondent to conceal a dishonest and unlawful managing of the figures which amounted to an unlawful deduction of wages.

15.

It is worthy of note that in neither the method of calculation nor in the change of format of the pay slip was the claimant or his union consulted by the respondent, and he did not give his consent when the respondent informed him of its explanations.

The issue of the standing of the right to be paid an enhanced rate and the claim of unlawful deduction of wages

THE RELEVANT LAW AND CONCLUSIONS

16. As regards the question of whether or not the standing of the enhanced payments amounts in this case to a term of the claimant's contract of employment, the tribunal has had regard to the guidance in Harvey, section A11D and to the relevant case law, including

Albion Automotive Ltd v Walker [2002] EWCA Civ 946, [2002] All ER (D) 170 (Jun).

The Court of Appeal in that case usefully listed relevant factors as follows:

(a) whether the policy was drawn to the attention of the employees;

(b) whether it was followed without exception for a substantial period;

(c) the number of occasions on which it was followed;

(d) whether payments were made automatically;

(e) whether the nature of communication of the policy supported the inference that the employers intended to be contractually bound;

(f) whether the policy was adopted by agreement;

(g) whether employees had a reasonable expectation that the enhanced payment would be made;

(h) whether terms were incorporated in a written agreement;

(i) whether the terms were consistently applied.

17. Whilst there are factual differences between the

Albion case and this, the guidance contained in

Albion provides a sound basis for reaching a decision in this case.

18. The tribunal is unanimously of the view that it beggars belief that the respondent was genuinely or reasonably of the view that this system of enhanced payments was anything other than a term of the claimant's contract of employment. Whilst the checklist in

Albion is not definitive, the items in the list contained in it are a very close fit to the status of the system under dispute in this case.

19. Whilst Mr Quigley was not in a position to bestow the enhanced payment system upon the claimant, it is the view of the tribunal that he was simply stating what everyone, including the respondent, already knew. There was no evidence of the respondent ever conducting an annual, or any, review of the system.

The legislation governing this aspect of the claimant's case is set out in

Article 45 of the Employment Rights (Northern Ireland) Order 1996:

"Right not to suffer unauthorised deductions

45.-”(1) An employer shall not make a deduction from wages of a worker employed by him unless -

(a) the deduction is required or authorised to be made by virtue of a statutory provision or a relevant provision of the worker's contract, or

(b) the worker has previously signified in writing his agreement or consent to the making of the deduction.

(2) In this Article "

relevant provision

", in relation to a worker's contract, means a provision of the contract comprised -

(a) in one or more written terms of the contract of which the employer has given the worker a copy on an occasion prior to the employer making the deduction in question, or

(b) in one or more terms of the contract (whether express or implied and, if express, whether oral or in writing) the existence and effect, or combined effect, of which in relation to the worker the employer has notified to the worker in writing on such an occasion.

(3) Where the total amount of wages paid on any occasion by an employer to a worker employed by him is less than the total amount of the wages properly payable by him to the worker on that occasion (after deductions), the amount of the deficiency shall be treated for the purposes of this Part as a deduction made by the employer from the worker's wages on that occasion.

(4) Paragraph (3) does not apply in so far as the deficiency is attributable to an error of any description on the part of the employer affecting the computation by him of the gross amount of the wages properly payable by him to the worker on that occasion.

(5) For the purposes of this Article a relevant provision of a worker's contract having effect by virtue of a variation of the contract does not operate to authorise the making of a deduction on account of any conduct of the worker, or any other event occurring, before the variation took effect.

(6) For the purposes of this Article an agreement or consent signified by a worker does not operate to authorise the making of a deduction on account of any conduct of the worker, or any other event occurring, before the agreement or consent was signified.

(7) This Article does not affect any other statutory provision by virtue of which a sum payable to a worker by his employer but not constituting "

wages

" within the meaning of this Part is not to be subject to a deduction at the instance of the employer".

20. It is also the view of the tribunal that the later position of the respondent, namely that the rate of pay should properly be pegged at the lower rate previously paid also flies in the face of the evidence. There was no evidence of the previous payments being capped or frozen; year on year, the rate of enhanced pay was as a consistent percentage of the prevailing basic rate of pay.

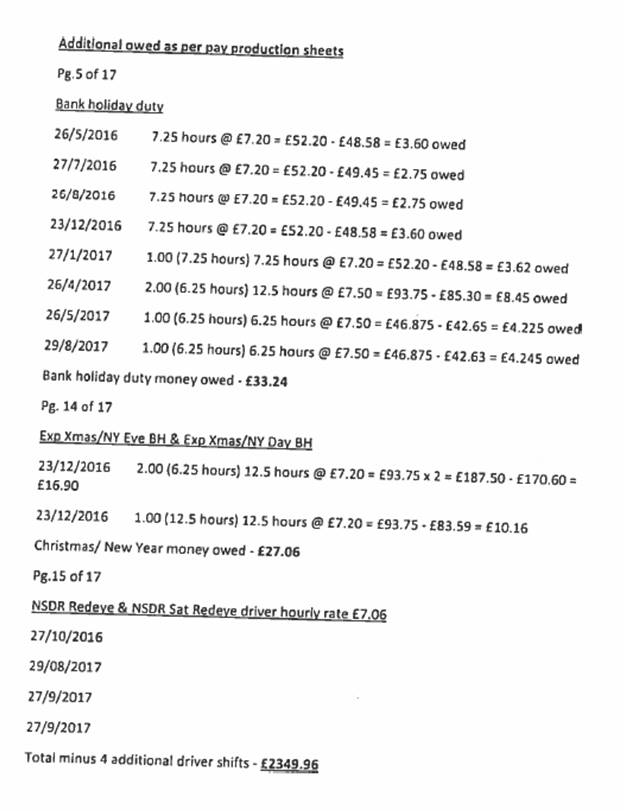

21. The tribunal therefore concludes that the respondent as a result of its miscalculation unlawfully deducted wages from the claimant. Whilst as a result of a grievance lodged by the claimant in early 2017 the respondent agreed that it was in breach of the National Minimum Wage Act by including the enhanced payments in calculating the claimant's hourly rate of pay, he had by the time of the tribunal hearing not received any of the money owed to him. It is therefore necessary to order the respondent to pay that amount to him, the figures for which are included in the claimant's schedule of loss, appended to and incorporated in to this decision.

The claim of right to an itemised pay statement

22. Whilst the claimant only sought to raise this as an issue in its submissions to the tribunal, the respondent does not object to its conclusion, and it has featured as an evidential issue from the outset. The claimant seeks only a declaration, and, since it is ongoing, the usual time limit of three months does not appear to apply. The respondent is not therefore prejudiced by its inclusion in the tribunal's deliberations. The tribunal therefore is unanimously of the view that it can properly consider this as a separate issue within the case.

23. The respondent during the tribunal hearing purported to welcome guidance from the tribunal as to the correct approach for it to take. The tribunal considers that this was highly unlikely to be true. The respondent had ample opportunity to reconsider its approach, but instead maintained an inflexible stance, despite what the tribunal views as clear and compelling evidence to the contrary of the respondent's argument throughout this process.

The relevant legislation

24.

The legislation governing this aspect of the case is contained in

Articles 40 to 44 of the Employment Rights (Northern Ireland) Order 1996:

"

Itemised pay statement

40.-”(1) An employee has the right to be given by his employer, at or before the time at which any payment of wages or salary is made to him, a written itemised pay statement.

(2) The statement shall contain particulars of -

(a)

the gross amount of the wages or salary,

(b)

the amounts of any variable, and (subject to Article (1)) any fixed, deductions from that gross amount and the purposes for which they are made,

(c)

the net amount of wages or salary payable, and

(d)

where different parts of the net amount are paid in different ways, the amount and method of payment of each part-payment.

...

References to Industrial Tribunals

43.-”(1) Where an employer does not give an employee a statement as required by Article 33, 36 or 40 (either because he gives him no statement or because the statement he gives does not comply with what is required), the employee may require a reference to be made to an industrial tribunal to determine what particulars ought to have been included or referred to in a statement so as to comply with the requirements of the Article concerned.

(2) Where -

(a)

a statement purporting to be a statement under Article 33 or 36, or a pay statement or a standing statement of fixed deductions purporting to comply with Article 40 or 41, has been given to an employee, and

(b)

a question arises as to the particulars which ought to have been included or referred to in the statement so as to comply with the requirements of this Part.

...

Determination of references

44.-”(1) Where, on a reference under Article 43(1), an industrial tribunal determines particulars as being those which ought to have been included or referred to in a statement given under Article 33 or 36, the employer shall be deemed to have given to the employee a statement in which those particulars were included, or referred to, as specified in the decision of the tribunal.

(2) On determining a reference under Article 43(2) relating to a statement purporting to be a statement under Article 33 or 36, an industrial tribunal may -

(a)

confirm the particulars as included or referred to in the statement given by the employer,

(b)

amend those particulars, or

(c)

substitute other particulars for them,

as the tribunal may determine to be appropriate; and the statement shall be deemed to have been given by the employer to the employee in accordance with the decision of the tribunal.

"

25.

The tribunal is unanimously of the view that the format of the pay slip issued to the claimant since February 2017 does not contain sufficient particulars for the purposes of the legislation, since it in effect masks the fact that the wrong method of calculation of hourly rates of pay is being used.

26. Whilst the respondent contends that this was to simplify the system, the tribunal has concluded that the only party it suited was the respondent. The tribunal reluctantly concludes that there is a compelling inference from the conduct of the respondent that its method of calculation of the enhanced pay rates was deliberately designed to short-change the claimant. The new "simplified" format of the pay slip was in the view of the tribunal intended by the respondent to dress up this flawed approach; it appears that only the vigilance of the claimant prevented him from being misled.

27. The tribunal therefore orders that the format of the pay slip provided to the claimant should be the same as that provided prior to February 2017.

REMEDY

28. The tribunal considers that the appropriate remedy should be payment by the respondent to the claimant of the sums set out in his schedule of loss, which the tribunal is satisfied are correct.

29

. The tribunal therefore appends that schedule of loss to this decision, and directs that the amount therein of £2349.96 be paid by the respondent to the claimant.

30. This is a relevant decision for the purposes of the Industrial Tribunals (Interest) Order (Northern Ireland) 1990.

Employment Judge:

Date and place of hearing: 26 and 27 October 2017, Belfast.

Date decision recorded in register and issued to parties: